March 9th, 2026

Improving your credit score before applying for a loan can make a significant difference in the terms and interest rates you receive.

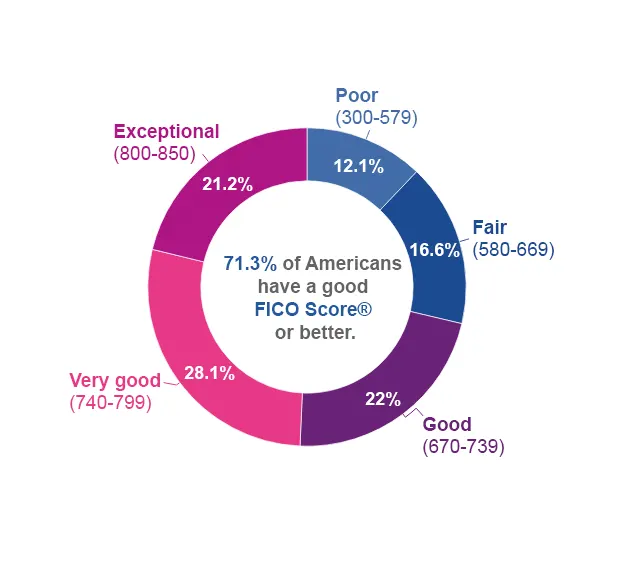

If your credit score is low, addressing credit repair before applying for a loan is crucial because a higher credit score significantly influences the terms and interest rates you’ll receive. A better credit score can qualify you for lower interest rates, reducing the overall cost of the loan and potentially saving you thousands of dollars over time.

Additionally, a clean credit history improves your chances of loan approval, as lenders view it as an indicator of your reliability and financial responsibility.

Addressing any inaccuracies, reducing outstanding debts, and improving your credit utilization ratio before applying ensures that you present the strongest possible financial profile to lenders, increasing your likelihood of securing favorable loan terms and avoiding potential rejections or higher costs.

Here are some effective strategies to boost your credit score:

1. Check Your Credit Report

- Get a Copy: Obtain your credit report from all three major credit bureaus: Equifax, Experian, and TransUnion. You can get a free copy from each bureau once a year at AnnualCreditReport.com.

- Review for Errors: Look for inaccuracies, such as incorrect account information or mistaken delinquencies. Dispute any errors you find to have them corrected.

2. Pay Your Bills on Time

- Set Up Reminders: Use reminders or automatic payments to ensure you never miss a due date.

- Prioritize Payments: Focus on paying bills that directly affect your credit score, like credit cards, loans, and mortgages.

3. Reduce Credit Card Balances

- Pay Down Debt: Aim to lower your credit card balances to below 30% of your credit limit, or even better, pay them off in full each month.

- Avoid New Debt: Refrain from taking on new credit card debt while you’re working to improve your score.

4. Increase Your Credit Limit

- Request a Higher Limit: Contact your credit card issuer to request an increase in your credit limit. This can help lower your credit utilization ratio, which is beneficial for your score.

- Don’t Use It: If granted a higher limit, try not to increase your spending.

5. Keep Old Accounts Open

- Maintain Account Age: Older credit accounts positively impact your credit score. Keep old accounts open even if you don’t use them regularly.

- Avoid Closing Accounts: Closing old accounts can shorten your credit history and negatively impact your score.

6. Diversify Your Credit Types

- Mix of Credit: Having a mix of credit types (e.g., credit cards, installment loans) can be beneficial. However, only take on new credit if you really need it and can manage it responsibly.

7. Limit Hard Inquiries

- Avoid Unnecessary Applications: Each hard inquiry can slightly decrease your credit score. Only apply for new credit when necessary.

- Rate Shopping: If you’re shopping for a loan or mortgage, try to do it within a short time frame to minimize the impact of multiple inquiries.

8. Become an Authorized User

- Use a Responsible Person’s Credit: If you’re added as an authorized user on a responsible person’s credit card, their positive payment history can benefit your score.

- Ensure They’re Responsible: Make sure the primary account holder has good credit habits.

9. Consider a Secured Credit Card

- Build or Rebuild Credit: A secured credit card, which requires a deposit as collateral, can help build or rebuild your credit if used responsibly.

- Make Timely Payments: Ensure you make all payments on time and keep your balance low.

10. Monitor Your Credit Regularly

- Use Credit Monitoring Tools: Regularly monitor your credit report to stay on top of your credit health and quickly address any issues that arise.

Implementing these strategies can help you improve your credit score and enhance your chances of securing a loan with favorable terms.

Secured and unsecured personal loans used for a variety of purposes, such as credit repair, debt consolidation, medical bills, vacations, or the payment of a large ticket item.

Last year this reached nearly $400 billion or about 10 percent of non-revolving consumer credit.

Although depository institutions such as banks, credit unions, and FinTech dominate the personal loan market, finance companies, institutions that typically lend to non-prime consumers, hold nearly a fourth of these loans.

How to smartly increase your credit limit in order to reduce overall credit usage ratio?

Increasing your credit limit can be a smart way to improve your credit utilization ratio, which in turn can boost your credit score. Here’s a step-by-step guide to doing it effectively:

1. Assess Your Current Credit Situation

- Review Your Credit Utilization: Check your current credit utilization ratio (credit card balances divided by credit limits). Aim for a utilization ratio below 30%, but the lower, the better.

- Check Your Credit Score: Ensure your credit score is in good standing before requesting a limit increase. A higher score improves your chances of approval.

2. Prepare for the Request

- Gather Information: Be ready to provide your current income, employment details, and any other relevant financial information.

- Evaluate Your Spending Habits: Ensure you are managing your current credit responsibly. Avoid applying for a limit increase if you have recent late payments or high balances.

3. Request a Credit Limit Increase

- Contact Your Credit Card Issuer: Call the customer service number on the back of your card or log in to your account online to request a limit increase.

- Specify Your Desired Increase: Be realistic about how much of an increase you need. Requesting too much might raise red flags.

- Provide Accurate Information: Fill in your income and employment information accurately. Some issuers may perform a hard inquiry, which can temporarily impact your credit score.

4. Strategize the Timing

- Wait for Positive Changes: If you’ve recently increased your income, paid down significant debt, or had other positive credit changes, it’s a good time to request a limit increase.

- Avoid Frequent Requests: Repeatedly asking for credit limit increases can be viewed negatively. Aim for a well-timed request rather than frequent ones.

5. Utilize the Increased Limit Wisely

- Maintain Low Balances: After receiving the increase, keep your spending in check to ensure your credit utilization remains low.

- Avoid Increasing Spending: Use the higher limit as a cushion rather than an excuse to spend more.

6. Monitor Your Credit Reports

- Check for Updates: After a limit increase, monitor your credit reports to ensure the new limit is reflected and your credit utilization ratio improves.

- Stay Informed: Keep track of your credit score to see how the increase affects your overall credit health.

7. Consider Other Strategies

- Request Increases Across Multiple Cards: If you have several credit cards, consider requesting increases on multiple cards to spread out your credit utilization.

- Review Your Overall Credit Profile: Ensure that all aspects of your credit profile are in good shape. A limit increase alone won’t be as effective if other factors, like high balances or missed payments, are dragging down your score.

8. Be Mindful of Potential Downsides

- Impact on Credit Score: A hard inquiry might temporarily lower your score, but the long-term benefits of a lower credit utilization ratio typically outweigh this impact.

- Increased Temptation: Higher credit limits can lead to increased spending if not managed carefully. Stick to your budget and spending plan.

By following these steps, you can effectively increase your credit limit and improve your credit utilization ratio, leading to a healthier credit score.

How to smartly diversify your credit usage in order to improve your credit score?

Diversifying your credit usage is an important strategy for improving your credit score. Credit scoring models generally favor a mix of different types of credit accounts, as it demonstrates your ability to manage various credit products responsibly. Here’s how to diversify your credit usage smartly:

1. Understand Different Credit Types

- Revolving Credit: Includes credit cards and lines of credit. The balance you owe can fluctuate, and you have the option to pay off the balance in full or make minimum payments.

- Installment Credit: Includes loans such as auto loans, mortgages, and personal loans. You make regular, fixed payments over a set period.

- Open Credit Accounts: Accounts where you are expected to pay the balance in full each month, such as utility bills or charge cards.

2. Add Different Types of Credit

- Apply for a Credit Card: If you don’t have one, opening a credit card can help diversify your credit profile. Consider options like cash-back, travel, or store credit cards.

- Get a Personal Loan: A personal loan can add variety to your credit mix. Use it for a specific purpose, like debt consolidation or a major purchase.

- Consider an Installment Loan: If you don’t already have one, taking out an installment loan (such as an auto loan or student loan) can diversify your credit mix.

- Secured Credit Card: If you’re building or rebuilding credit, a secured credit card can help. It requires a deposit but functions like a regular credit card.

3. Manage New Credit Responsibly

- Apply for Credit Sparingly: Avoid applying for multiple new accounts in a short period, as this can negatively impact your credit score. Only apply for credit you genuinely need.

- Keep Accounts Active: Use your credit accounts periodically and pay them off promptly. Inactive accounts may eventually be closed by the issuer.

4. Maintain a Positive Payment History

- Pay on Time: Ensure you make all your payments on time, regardless of the type of credit. Timely payments are crucial for maintaining a good credit score.

- Avoid Overextending Yourself: Only take on as much credit as you can manage responsibly. Overextending yourself can lead to missed payments and increased debt.

5. Monitor Your Credit Utilization

- Keep Utilization Low: For revolving credit accounts, keep your credit utilization ratio (credit card balances divided by credit limits) below 30%. Lower utilization ratios are better for your credit score.

- Pay Balances Regularly: Regularly pay down balances to maintain a low utilization ratio and avoid interest charges.

6. Diversify Credit Accounts Gradually

- Start Slowly: Gradually add different types of credit accounts rather than applying for several at once. This approach helps you manage each account responsibly and builds a positive credit history.

- Review Your Credit Mix: Periodically review your credit report to ensure you have a balanced mix of credit types and that all accounts are in good standing.

7. Leverage Existing Credit Wisely

- Increase Credit Limits: As discussed earlier, increasing your credit limits can lower your credit utilization ratio and positively affect your score.

- Consider Balance Transfers: If you have multiple credit cards, consolidating balances to a card with a lower interest rate can be a strategic way to manage debt and utilize credit responsibly.

8. Regularly Check Your Credit Reports

- Monitor for Accuracy: Regularly check your credit reports for errors or inaccuracies. Dispute any discrepancies to ensure your credit profile accurately reflects your credit behavior.

9. Seek Professional Advice if Needed

- Consult a Credit Counselor: If you’re unsure how to diversify your credit or manage it effectively, consider seeking advice from a credit counselor or financial advisor.

By following these strategies, you can smartly diversify your credit usage, which can help improve your credit score over time and demonstrate your ability to handle various types of credit responsibly.

Tips only experts utilize to improve credit score for getting loans?

Improving your credit score to enhance your chances of securing a loan involves strategies that go beyond basic advice. Here are some expert tips that can help:

1. Leverage the Timing of Your Credit Utilization

- Utilize Balance Reporting Dates: Credit card companies often report your balance to the credit bureaus on a specific date each month. If you pay down your balance before this date, your reported utilization will be lower, which can boost your score. Check with your issuer to find out when your statement is reported.

2. Strategically Dispute Errors

- Use Specific Dispute Language: When disputing errors on your credit report, use precise language and provide detailed evidence. Instead of just stating an error, explain why the entry is incorrect and include supporting documents. This increases the chances of a favorable outcome.

3. Understand the Impact of Hard vs. Soft Inquiries

- Limit Hard Inquiries: Hard inquiries can lower your score temporarily. When applying for new credit, space out your applications and try to minimize hard inquiries. For rate shopping (like for a mortgage), multiple inquiries within a short period typically count as a single inquiry.

4. Utilize Credit-Boosting Tools and Services

- Consider Experian Boost: Services like Experian Boost allow you to add utility and telecom payment histories to your credit report, which can potentially increase your credit score if you have a positive payment history with these accounts.

5. Optimize Your Credit Card Usage

- Split Your Payments: Instead of making one payment per month, consider splitting your payments into two. This can help keep your balance lower throughout the month and reduce your credit utilization ratio more effectively.

- Use Multiple Cards Wisely: Spread your spending across multiple cards to keep the utilization ratio on each card low. Just be sure to manage them responsibly and avoid accumulating debt.

6. Manage Your Credit Mix Strategically

- Add Installment Loans Carefully: If you only have revolving credit (like credit cards), consider adding a small installment loan (like a personal loan) to diversify your credit mix. Ensure you can manage the payments without affecting your financial stability.

7. Optimize Authorized User Accounts

- Choose the Right Account: If you’re becoming an authorized user on someone else’s account, select an account with a long positive history and low utilization. This can positively impact your credit profile more effectively.

8. Understand the Impact of Credit Age

- Strategically Open New Accounts: Opening new credit accounts can lower your average account age, which can impact your score. If you need to open a new account, try to do so when you have a longer history and fewer recent inquiries.

9. Review Your Credit Reports Regularly

- Look Beyond the Basics: Regularly review your credit reports for not only errors but also for trends in your credit behavior. Identifying patterns (such as high utilization during specific months) can help you adjust your financial habits accordingly.

10. Use Financial Tools and Apps

- Track Your Progress: Utilize credit monitoring tools and apps to track changes in your score and get personalized advice based on your credit profile. Many apps offer insights into what actions can improve your score.

11. Negotiate with Creditors

- Request a Goodwill Adjustment: If you have a strong payment history but a single missed payment, you can request a goodwill adjustment from your creditor to remove the negative mark. Be polite and provide context for your request.

12. Leverage Credit Counseling Services

- Professional Guidance: Seek advice from a certified credit counselor if you’re struggling to manage your credit. They can provide personalized strategies and help you create a plan to improve your credit profile.

13. Use Secured Credit Cards Strategically

- Advance Your Credit with Secured Cards: Use a secured credit card to build or rebuild credit. Make sure the issuer reports to all three credit bureaus and use the card responsibly to enhance your credit profile.

14. Consider Credit Building Loans

- Use Credit Building Loans: These are small loans designed to help build or improve credit. The loan amount is held in a savings account until you repay the loan, which helps build your credit history and score.

Implementing these expert tips can help you refine your credit strategy and improve your credit score effectively, increasing your chances of securing favorable loan terms.

--- article sharing ---