Video content marketing is a cost-effective and powerful strategy for businesses to generate high-quality leads. By leveraging various social platforms, companies can reach a vast…

View More Video Content Marketing ServicesCategory: Slider

Content Marketing Services

You designed, built or crafted an excellent product or service. But this is merely the first step in your journey to success. You will need…

View More Content Marketing ServicesSmall Business Loans and Grants

At slower economic growth times, small to medium sized businesses have much higher demand for some kind of borrowing to help business growth, market share…

View More Small Business Loans and GrantsOnline courses can help professionals become certified and fill the nearly 12 million current vacant positions

In July 2022, there were 11.24 million vacant position for the single month, nearly double the total pool of available workers for that month, which…

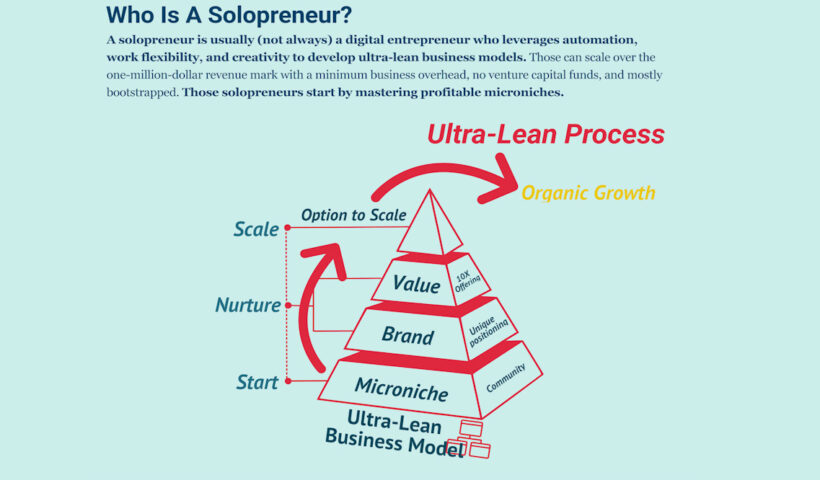

View More Online courses can help professionals become certified and fill the nearly 12 million current vacant positionsSolopreneurs are more than 40 million American business owners that are fast becoming millionaires

Solopreneurs are a new kind of entrepreneur, whom work without employees and are a one-person business (self-owned and operated). They are on the rise, work…

View More Solopreneurs are more than 40 million American business owners that are fast becoming millionairesContent marketing strategists tips on developing content strategy

Content marketing is now the most effective and least costly marketing method compared to Google Ads and Bing Ads, or other forms of online advertising…

View More Content marketing strategists tips on developing content strategyWhat is an NFT Non-Fungible Tokens?

What is an NFT Non-Fungible Tokens? There’s nothing like a new terminology that leaves you thinking, “Um… why is it that there is so many…

View More What is an NFT Non-Fungible Tokens?Small business owners Google Ads lead generation is no longer viable and they say they can no longer compete on Google Ads to get sales

There is a very familiar concern among business owners regarding advertising their products and services on the Google advertising platform (Google Ads, previously known as…

View More Small business owners Google Ads lead generation is no longer viable and they say they can no longer compete on Google Ads to get salesWhy Elon Musk is supporting Reg A+ investing for raising $20 million or more for your business?

You are a business owner, right? Do you know about Reg A+ investing for raising $20 million or more for your business? Like almost all…

View More Why Elon Musk is supporting Reg A+ investing for raising $20 million or more for your business?Business ownership strategies during hyperinflation, supply chain issues, and rising interest rates

Latest survey of 5,000 small business owners in the U.S. is suggesting that small business owners are still optimistic, although many entrepreneurs are asking about…

View More Business ownership strategies during hyperinflation, supply chain issues, and rising interest rates