February 12th, 2026

Getting approved for a loan with bad credit can be challenging, but it’s not impossible.

Navigating the world of loans with bad credit might feel like a daunting maze, but armed with savvy strategies, you can turn the tables in your favor.

You can transform your credit woes into a stepping stone for financial freedom by diligently checking your credit report, leveraging a co-signer, and exploring secured options, you can unlock doors that once seemed closed.

There are some smarter financial maneuvers, from offering a larger down payment to showcasing your income stability, and watch as opportunities unfold.

With each strategic move, you’re not just seeking approval; you’re crafting a blueprint for a brighter, more secure financial future.

Here are ten tips to increase your chances:

- Check Your Credit Report: Before applying, review your credit report for errors or inaccuracies. Dispute any mistakes with the credit bureaus to potentially improve your score.

- Improve Your Credit Score: Take steps to boost your credit score before applying. Pay down outstanding debts, make payments on time, and reduce your credit card balances.

- Consider a Co-Signer: If possible, enlist a co-signer with good credit. Their positive credit history can help offset your own credit issues and improve your chances of approval.

- Explore Secured Loans: Secured loans, where you provide collateral (like a car or savings account), can be easier to get approved for with bad credit. The collateral reduces the lender’s risk.

- Shop Around: Different lenders have different criteria for approving loans. Shop around and compare offers from various lenders, including credit unions and online lenders, which may be more flexible.

- Consider a Personal Loan: Some lenders specialize in offering personal loans to individuals with poor credit. Be prepared for higher interest rates, but these loans can help you build credit if you make timely payments.

- Provide Proof of Income: Demonstrating a steady income can reassure lenders that you can repay the loan. Gather documentation such as pay stubs, tax returns, or bank statements.

- Offer a Larger Down Payment: If you’re applying for a loan that requires a down payment (like an auto loan or mortgage), offering a larger down payment can improve your chances of approval.

- Demonstrate Financial Stability: Show evidence of financial stability, such as a consistent work history and a budget that balances income and expenses. Lenders want to see that you can manage your finances responsibly.

- Be Honest and Transparent: Provide accurate information on your loan application and be upfront about your credit situation. Lenders appreciate transparency and it can help build trust.

It’s important to consider that, even if you’re approved with bad credit, you might face higher interest rates and less favorable terms. Improving your credit over time can help you secure better loan conditions in the future.

Secrets of Getting a Loan with Bad Credit

Securing a loan with bad credit has become less of a mystery and more about leveraging new insights and strategies. Here are some of the top secrets that have emerged for getting approved even with less-than-perfect credit:

- Alternative Credit Scoring Models: Many lenders are now using alternative credit scoring models that consider more than just your traditional credit score. These models may include your payment history for utilities, rent, and even social media activity, providing a more comprehensive view of your financial behavior.

- Micro-Lenders and Peer-to-Peer Platforms: Innovative micro-lenders and peer-to-peer lending platforms have emerged as viable options for those with bad credit. These platforms often have more flexible criteria and are willing to work with borrowers who might be overlooked by traditional banks.

- Credit Builder Loans: These are designed specifically for people with bad credit or no credit history. You borrow a small amount, which is held in a secured account, and make payments towards it. As you repay, the lender reports your positive payment history to the credit bureaus, helping to build your credit score.

- Automatic Payment Setup: Lenders are increasingly appreciating borrowers who set up automatic payments. It signals financial responsibility and reliability, which can sometimes sway a lender’s decision, even if your credit score isn’t stellar.

- Refinancing Potential: Some borrowers are discovering that they can start with a high-interest loan and, after demonstrating improved credit behavior, refinance to better terms later. This strategy can be particularly useful for loans like auto loans or personal loans.

- Customized Loan Terms: Newer lending technologies and platforms can offer customized loan terms based on your specific financial situation. This personalization can sometimes mean getting a loan even with bad credit, provided you meet other criteria.

- Documented Income and Savings: Presenting well-documented and consistent sources of income and savings can be a powerful counterweight to a bad credit score. It shows lenders that you have the means to repay the loan, despite past credit issues.

- Short-Term Loans for Immediate Needs: Some lenders offer short-term loans with higher interest rates but less stringent credit requirements. While they’re not ideal for long-term borrowing, they can provide immediate relief and serve as a stepping stone for improving your credit.

- Secured Credit Cards as a Bridge: Using a secured credit card, where you put down a deposit that acts as your credit limit, can help build or rebuild your credit. Many lenders view a positive history with secured cards favorably when considering loan applications.

- Leveraging Relationships with Local Credit Unions: Local credit unions often have more flexibility than larger banks and may offer better terms or be more willing to work with individuals with bad credit, especially if you have been a long-time member.

By understanding and utilizing these smart strategies, you can improve your chances of getting approved for a loan despite a challenging credit history.

How to use Micro-Lenders and Peer-to-Peer Platforms for Getting a Loan

Using micro-lenders and peer-to-peer (P2P) platforms can be a strategic approach for securing a loan with bad credit. Here’s a step-by-step guide on how to effectively use these resources:

Micro-Lenders

- Research Micro-Lenders: Start by identifying reputable micro-lenders in your area or online. These are often community-based lenders or nonprofit organizations that specialize in providing small loans to individuals with limited access to traditional credit.

- Understand the Requirements: Each micro-lender may have different criteria for approval. Review their requirements carefully to ensure you meet them, such as minimum income levels or proof of residency.

- Prepare Your Documentation: Gather all necessary documents, such as proof of income, identification, and any other required paperwork. Micro-lenders often focus on your current financial situation rather than past credit issues.

- Apply for the Loan: Complete the application process, which may involve filling out forms online or in person. Be transparent about your financial situation and explain any past credit issues to improve your chances of approval.

- Seek Guidance: Many micro-lenders offer financial counseling or support services. Take advantage of these resources to improve your financial management and increase your likelihood of securing a loan.

Peer-to-Peer (P2P) Platforms

- Choose the Right Platform: Research various P2P lending platforms such as LendingClub, Prosper, or Upstart. Each platform has its own lending criteria and borrower requirements, so choose one that aligns with your needs.

- Review Platform Policies: Understand the platform’s policies, including interest rates, fees, and loan terms. Some platforms may be more lenient with credit scores and offer better terms for those with poor credit.

- Create a Strong Profile: When you apply on a P2P platform, you’ll need to create a borrower profile. Highlight your financial stability, employment history, and any other positive aspects of your financial situation. A well-crafted profile can attract lenders who are more willing to take a chance on you.

- Explain Your Situation: Provide a clear and honest explanation of why you need the loan and how you plan to use it. Transparency can build trust with potential lenders and improve your chances of getting funded.

- Set a Realistic Loan Amount: Request an amount that you can reasonably repay based on your current financial situation. Asking for a smaller loan can make it easier to get approved and manage repayment.

- Monitor Your Application: After applying, keep track of your application’s progress. Engage with potential lenders if the platform allows, and respond promptly to any queries or additional information requests.

- Evaluate Offers: If your loan request is approved, you’ll receive offers from individual investors. Compare these offers to find the best interest rates and terms.

- Manage Your Loan Responsibly: Once you secure the loan, make sure to manage it responsibly by making timely payments. Positive repayment behavior will not only help you maintain the loan but also improve your credit score for future borrowing.

By effectively leveraging micro-lenders and P2P platforms, you can access loans even with bad credit, while potentially benefiting from more personalized terms and support.

How to use Customized Loan Terms and Newer lending technologies

Using customized loan terms and newer lending technologies can be a game-changer for securing a loan with bad credit. Here’s how you can effectively leverage these tools:

Customized Loan Terms

- Research Lenders Offering Customization: Look for lenders or financial institutions that provide customized loan terms. These lenders may use advanced algorithms or personalized services to tailor loan offers to your specific financial situation.

- Assess Your Needs and Preferences: Before applying, understand what kind of loan terms you need. Consider factors such as loan amount, repayment period, and interest rates that fit your budget and financial goals.

- Provide Detailed Financial Information: Be prepared to share detailed information about your income, expenses, and any assets you have. This allows lenders to create a loan offer that is more suited to your financial situation.

- Utilize Prequalification Tools: Many lenders offer prequalification tools that give you an idea of the terms you might receive without affecting your credit score. Use these tools to compare offers and find the best terms before formally applying.

- Negotiate Terms: Don’t hesitate to negotiate loan terms with lenders. If you have a clear understanding of your financial situation and what you can afford, you may be able to secure more favorable terms.

Newer Lending Technologies and Platforms

- Explore Fintech Lenders: Fintech companies use technology to provide innovative lending solutions. Research fintech lenders known for their flexible criteria and advanced technology. Companies like Upstart or Avant often use non-traditional data to assess creditworthiness.

- Use Online Loan Marketplaces: Online marketplaces aggregate loan offers from various lenders. Platforms like LendingTree or Credible allow you to compare multiple offers quickly. These platforms often include lenders who are open to working with borrowers with bad credit.

- Leverage AI and Machine Learning Tools: Some lenders use artificial intelligence (AI) and machine learning to evaluate loan applications. These technologies analyze a wide range of data points beyond just credit scores, which can improve your chances of approval.

- Consider Digital Banks and Neobanks: Digital banks and neobanks often have more lenient lending criteria and use technology to streamline the borrowing process. Look into these options for potentially better terms and quicker approvals.

- Take Advantage of Instant Decision Tools: Many newer lending platforms offer instant decision tools that can provide immediate feedback on your application. This can help you quickly determine if you qualify for a loan and what terms you might receive.

- Monitor Your Loan Application Status: Newer lending platforms often provide real-time updates on your loan application status. Stay engaged and respond promptly to any requests for additional information to keep your application moving smoothly.

- Use Financial Management Apps: Some apps can help you manage your finances more effectively, which can improve your overall credit profile. For example, apps that help with budgeting or tracking expenses can demonstrate to lenders that you’re responsible with your finances.

By utilizing customized loan terms and embracing newer lending technologies, you can enhance your chances of securing a loan with bad credit. These tools and strategies enable you to find loan options that are better aligned with your financial situation and needs.

Lenders that specialize specifically for loans to individuals with bad credit

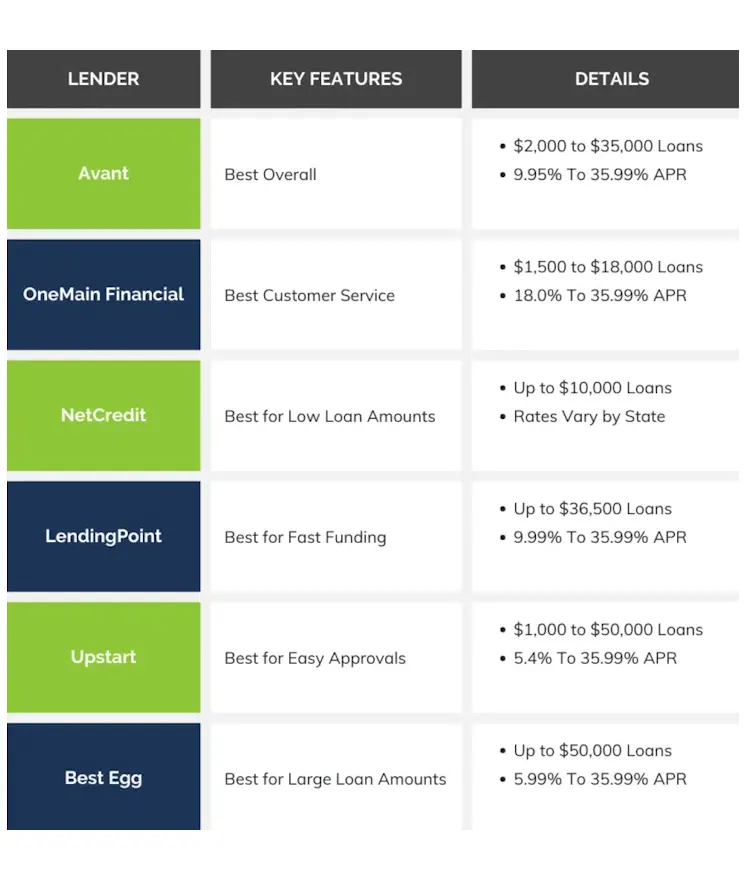

For individuals with bad credit, several lenders specialize in offering loans tailored to those with challenging credit histories. Here’s a list of lenders and financial institutions known for working with borrowers who have bad credit:

1. Avant

Avant is a well-known online lender that provides personal loans to individuals with less-than-perfect credit. They offer a straightforward application process and quick funding, with a focus on accommodating borrowers with credit scores below 600.

2. OneMain Financial

OneMain Financial specializes in personal loans for people with bad credit. They offer secured and unsecured loan options, and their application process considers factors beyond just credit scores, such as your income and overall financial situation.

3. Upstart

Upstart uses a combination of artificial intelligence and alternative data to assess borrowers. This approach allows them to offer loans to individuals with bad credit or limited credit histories by evaluating other factors like education and employment history.

4. LendingClub

LendingClub is a peer-to-peer lending platform that connects borrowers with investors willing to fund their loans. They have options for individuals with lower credit scores and offer both personal and debt consolidation loans.

5. Prosper

Prosper is another peer-to-peer lending platform that offers personal loans to borrowers with bad credit. They evaluate loan applications based on a variety of criteria, which can make it easier for those with poor credit to get approved.

6. BadCreditLoans.com

As the name suggests, BadCreditLoans.com specializes in connecting borrowers with bad credit to lenders willing to offer personal loans. They act as a marketplace, providing access to a variety of lenders who are open to working with individuals with poor credit.

7. PersonalLoans.com

PersonalLoans.com is an online loan marketplace that connects borrowers with lenders offering various types of loans, including options for those with bad credit. They provide a range of loan amounts and terms, making it easier to find a suitable loan.

8. Peerform

Peerform is a P2P lending platform that allows borrowers with bad credit to secure loans from individual investors. They use a proprietary credit scoring model that includes alternative data, which can be beneficial for those with poor credit histories.

9. Rise Credit

Rise Credit provides short-term loans to individuals with bad credit. They offer a range of loan amounts and terms and focus on helping borrowers with immediate financial needs.

10. CreditFresh

CreditFresh offers a type of personal line of credit that is accessible to individuals with bad credit. Their flexible repayment terms and ability to draw funds as needed can be advantageous for those who need ongoing financial support.

Tips for Working with These Lenders:

- Compare Rates and Terms: Even within the realm of bad credit loans, rates and terms can vary significantly. Make sure to compare offers to find the best deal.

- Check Fees: Be aware of any fees associated with the loan, such as origination fees or prepayment penalties.

- Read the Fine Print: Ensure you fully understand the terms and conditions before signing any agreement.

- Consider Your Budget: Make sure the loan terms fit within your budget to avoid further financial strain.

By exploring these lenders and utilizing their services, you can find loan options that cater specifically to individuals with bad credit, helping you access the funds you need despite past financial challenges.

--- article sharing ---