January 28th, 2026

Choosing the best loan for your home improvement project involves evaluating various financing options to find the one that best fits your financial situation, project needs, and long-term goals.

Your home improvement project involves a strategic blend of assessing project needs, exploring diverse financing options, and evaluating lender offerings.

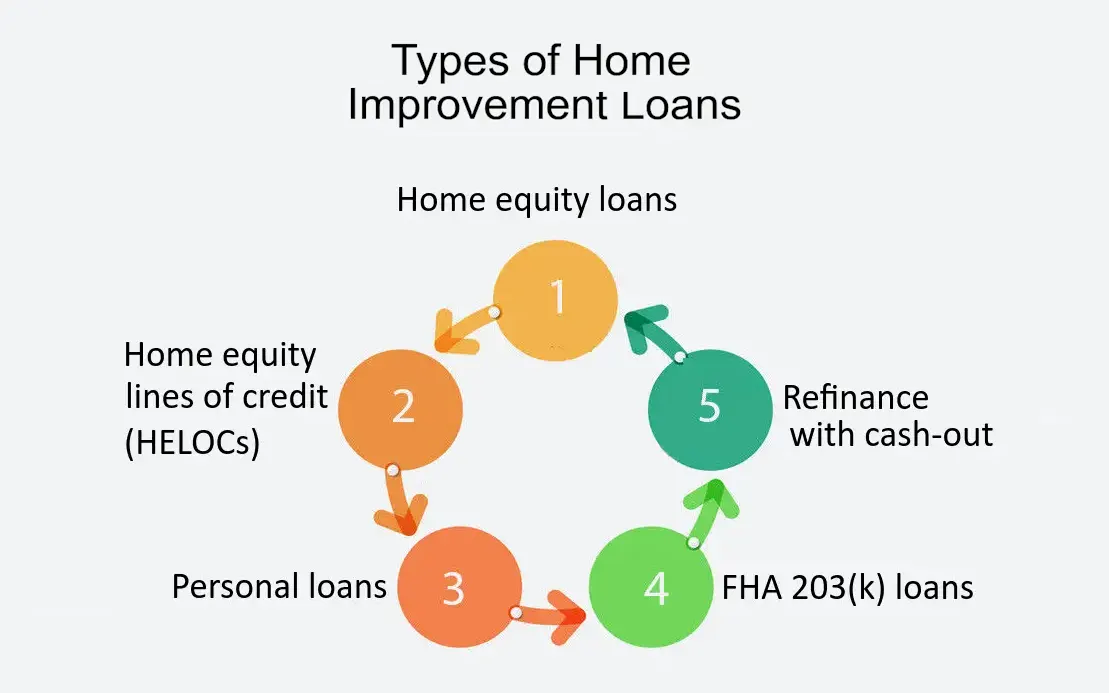

Start by clearly defining your project costs and budget, then compare loan types such as home equity loans, HELOCs, cash-out refinances, personal loans, and credit cards to find the most suitable option for your financial situation.

Focus on innovative strategies like leveraging home equity for potentially lower rates or using personal loans for flexibility, while carefully comparing interest rates, fees, and repayment terms.

Consulting with financial advisors and contractors can provide tailored insights, ensuring you select a loan that aligns with your budget, project goals, and long-term financial health.

Here’s a guide to help you select the right loan for your home improvement project:

1. Assess Your Project Needs and Budget

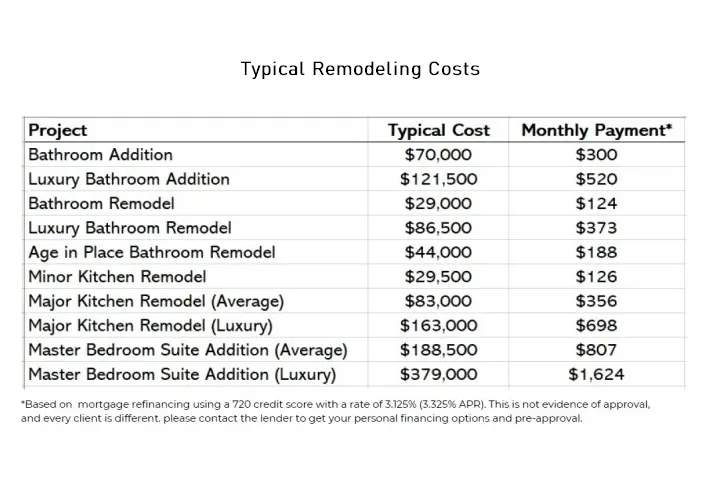

- Determine Project Costs: Get detailed estimates for your home improvement project to understand the total cost. This will help you determine how much you need to borrow.

- Budget for Additional Expenses: Consider including a buffer for unexpected costs that might arise during the project.

2. Explore Loan Options

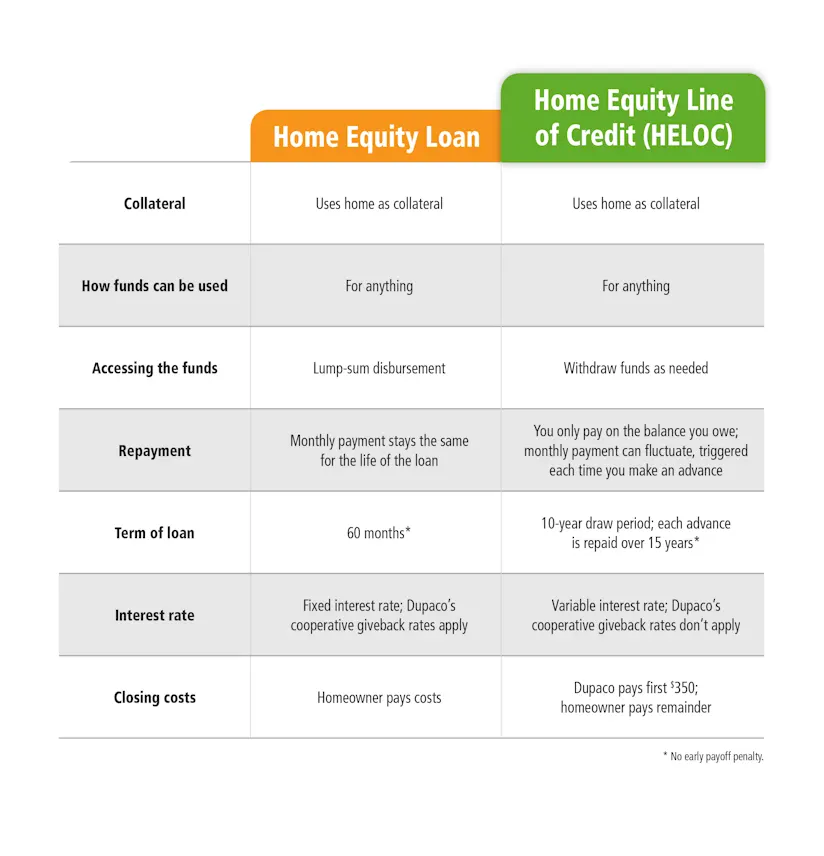

Home Equity Loan

- Overview: A home equity loan allows you to borrow against the equity in your home with a fixed interest rate and fixed monthly payments.

- Best For: Larger projects where you need a substantial amount of money and prefer fixed payments.

- Pros: Fixed rates, predictable payments, potentially lower interest rates than personal loans.

- Cons: Requires significant home equity, closing costs, and potential fees.

Home Equity Line of Credit (HELOC)

- Overview: A HELOC is a revolving line of credit secured by your home’s equity. It offers a variable interest rate and allows you to borrow as needed up to a credit limit.

- Best For: Ongoing or phased projects where you need flexibility and access to funds over time.

- Pros: Flexibility to draw funds as needed, interest-only payments during the draw period.

- Cons: Variable rates can lead to payment fluctuations, risk of foreclosure if you default.

Cash-Out Refinance

- Overview: A cash-out refinance replaces your existing mortgage with a new, larger mortgage, and you receive the difference in cash.

- Best For: Large projects where you want to take advantage of lower mortgage rates or consolidate debt.

- Pros: Potentially lower mortgage rates, simplifies debt management.

- Cons: Extends the term of your mortgage, closing costs, and fees.

Personal Loan

- Overview: Unsecured personal loans can be used for home improvements and do not require home equity.

- Best For: Smaller projects or when you don’t have enough equity in your home.

- Pros: No collateral required, quick approval process.

- Cons: Higher interest rates compared to home equity loans, shorter repayment terms.

Credit Card

- Overview: Using a credit card for home improvements offers short-term financing with the option to pay off the balance over time.

- Best For: Smaller projects or if you need immediate access to funds.

- Pros: Quick access to funds, potential rewards or cash back.

- Cons: High-interest rates, especially if the balance is not paid off quickly.

3. Compare Loan Terms and Costs

- Interest Rates: Compare interest rates for each loan option. Fixed rates offer stability, while variable rates (e.g., HELOCs) may fluctuate.

- Fees and Closing Costs: Consider any fees, closing costs, or prepayment penalties associated with each loan.

- Repayment Terms: Evaluate the length of the loan and monthly payment amounts. Ensure they fit within your budget.

4. Evaluate Lender Options

- Check Lender Reviews: Research lenders to find those with good customer reviews and transparent terms.

- Compare Offers: Get quotes from multiple lenders to compare rates, terms, and fees.

- Consider Customer Service: Choose lenders known for their customer support and ease of the application process.

5. Assess Your Financial Situation

- Credit Score: Ensure your credit score is in good shape, as it can impact your loan terms and approval chances.

- Income and Debt: Evaluate your income and existing debt to ensure you can comfortably handle new loan payments.

6. Consult Professionals

- Financial Advisor: A financial advisor can provide personalized advice based on your financial situation and goals.

- Home Improvement Contractor: Consult with your contractor to ensure your project estimates are accurate and align with your loan amount.

By carefully considering your project needs, exploring various loan options, and evaluating lenders, you can select the best loan to finance your home improvement project effectively.

What are the Best Loan Strategies for Your Home Improvement Project

Choosing the best loan for your home improvement project depends on factors like the size of the project, your financial situation, and your long-term plans. Here’s a breakdown of the most suitable loan options, each with its benefits and ideal use cases:

1. Home Equity Loan

- Overview: A home equity loan allows you to borrow against the equity you’ve built up in your home. It comes with a fixed interest rate and fixed monthly payments.

- Best For: Large-scale home improvements or significant renovations where you need a substantial amount of money.

- Pros: Fixed rates provide predictable payments, typically lower interest rates than personal loans, and potential tax-deductible interest.

- Cons: Requires substantial home equity, involves closing costs, and you risk foreclosure if you default.

2. Home Equity Line of Credit (HELOC)

- Overview: A HELOC is a revolving line of credit secured by your home’s equity, with a variable interest rate. You can borrow as needed up to a set limit.

- Best For: Projects that require ongoing funding or phased improvements where you need flexibility to draw funds as needed.

- Pros: Flexibility to borrow and repay as needed, interest-only payments during the draw period, and potentially lower interest rates compared to credit cards.

- Cons: Variable rates can lead to fluctuating payments, and there’s a risk of foreclosure if you default.

3. Cash-Out Refinance

- Overview: A cash-out refinance replaces your existing mortgage with a new, larger one, and you receive the difference in cash to use for home improvements.

- Best For: Large projects where you want to refinance your mortgage to access additional funds and potentially lower your overall mortgage rate.

- Pros: Potentially lower mortgage rates, consolidates debt, and simplifies finances by combining your mortgage and home improvement financing.

- Cons: Extends your mortgage term, involves closing costs, and may have higher interest rates than home equity loans.

4. Personal Loan

- Overview: An unsecured personal loan can be used for any purpose, including home improvements, and doesn’t require collateral.

- Best For: Smaller home improvement projects or if you lack sufficient home equity.

- Pros: No collateral required, quick application process, and flexible use of funds.

- Cons: Higher interest rates compared to home equity loans and shorter repayment terms, which could lead to higher monthly payments.

5. Credit Card

- Overview: Using a credit card for home improvements provides short-term financing with the option to pay off the balance over time.

- Best For: Smaller projects or if you need immediate access to funds for a short-term expense.

- Pros: Quick access to funds, potential rewards or cash back, and no need for collateral.

- Cons: High interest rates if not paid off quickly, which can lead to increased debt and financial strain.

6. FHA 203(k) Loan

- Overview: An FHA 203(k) loan is a government-backed mortgage that allows you to finance both the purchase of a home and the cost of improvements into a single loan.

- Best For: Buying a home that needs significant repairs or renovations, especially for first-time homebuyers.

- Pros: Combines purchase and renovation costs into one loan, lower down payment requirements, and may be easier to qualify for.

- Cons: Requires FHA mortgage insurance, and there may be additional fees and paperwork involved.

7. VA Renovation Loan

- Overview: Available to veterans and active-duty service members, this loan allows you to finance home improvements along with the purchase or refinance of a home.

- Best For: Eligible military personnel looking to make renovations or improvements to their home.

- Pros: No down payment required, competitive interest rates, and no mortgage insurance.

- Cons: Available only to eligible veterans and service members, and there may be specific requirements for the types of improvements.

Considerations When Choosing a Loan:

- Project Size: Match the loan amount and type to the scale of your project.

- Interest Rates: Compare rates to ensure you get the best deal. Fixed rates offer stability, while variable rates can be more flexible.

- Fees and Costs: Evaluate any associated fees, closing costs, and potential penalties.

- Repayment Terms: Consider how long you’ll be paying off the loan and how it fits into your budget.

- Financial Situation: Ensure that the loan you choose aligns with your overall financial health and future plans.

By carefully evaluating these loan options based on your project needs and financial situation, you can select the best loan to finance your home improvement project effectively.

What Are the Interest Rates for Each Home Improvement Loans?

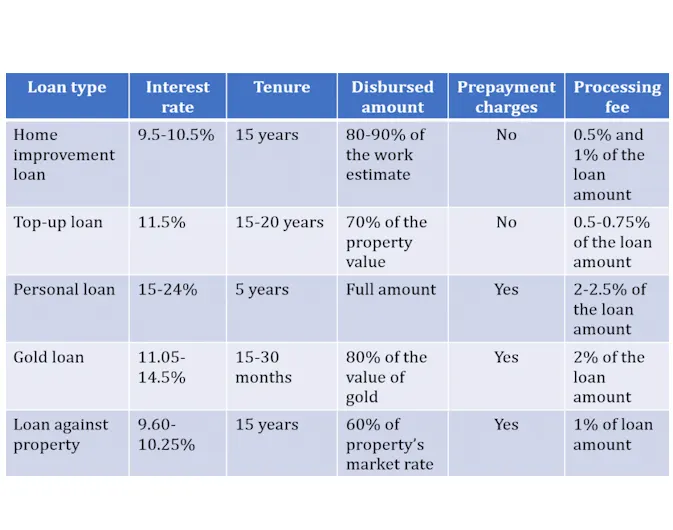

Interest rates for home improvement loans vary based on the type of loan, your credit profile, lender policies, and current market conditions. Here’s a general overview of the typical interest rates for each type of home improvement loan:

1. Home Equity Loan

- Typical Interest Rates: Generally range from 5% to 8% APR.

- Factors Affecting Rates: Your credit score, home equity, loan term, and lender’s policies. Fixed rates are common for home equity loans.

2. Home Equity Line of Credit (HELOC)

- Typical Interest Rates: Usually range from 6% to 10% APR.

- Factors Affecting Rates: Variable rates are common, influenced by the prime rate, your credit score, and the amount of home equity.

3. Cash-Out Refinance

- Typical Interest Rates: Typically range from 5% to 7% APR.

- Factors Affecting Rates: Your credit score, the size of your existing mortgage, and the current mortgage market conditions. Rates may be slightly higher than standard refinance rates due to the cash-out feature.

4. Personal Loan

- Typical Interest Rates: Generally range from 6% to 36% APR.

- Factors Affecting Rates: Your credit score, income, and loan term. Personal loans are unsecured, so rates can be higher compared to secured loans.

5. Credit Card

- Typical Interest Rates: Typically range from 15% to 25% APR.

- Factors Affecting Rates: Your credit score, credit card issuer, and current interest rate environment. Credit cards usually have the highest interest rates among home improvement financing options.

6. FHA 203(k) Loan

- Typical Interest Rates: Generally range from 4% to 6% APR.

- Factors Affecting Rates: The borrower’s credit score, the lender’s policies, and the specifics of the renovation project. FHA 203(k) loans can offer competitive rates compared to other renovation loans.

7. VA Renovation Loan

- Typical Interest Rates: Typically range from 3.5% to 5% APR.

- Factors Affecting Rates: Available to eligible veterans and service members. Rates are generally lower than conventional loans due to the VA’s backing.

General Considerations:

- Credit Score Impact: Higher credit scores typically qualify for lower interest rates, while lower scores may result in higher rates.

- Loan Term: Longer loan terms can lead to higher overall interest costs, though monthly payments might be lower.

- Market Conditions: Interest rates fluctuate with market conditions, so it’s beneficial to shop around and compare offers to get the best rate available at the time.

How to Find the Best Rates:

- Compare Lenders: Get quotes from multiple lenders to compare rates and terms.

- Check for Discounts: Some lenders offer discounts or promotions that could reduce your rate.

- Review Your Credit Report: Ensure your credit report is accurate and address any issues to improve your credit score and secure better rates.

By understanding the typical interest rates for different home improvement loans and considering the factors that affect these rates, you can make a more informed decision and choose the loan that best fits your financial situation and project needs.

How Much Can I Borrow with Various Loans Available for Home Improvement?

The amount you can borrow for home improvement depends on the type of loan and various other factors such as your credit profile, home equity, and lender policies. Here’s a breakdown of typical borrowing limits for each type of loan:

1. Home Equity Loan

- Typical Borrowing Limits: Generally range from 80% to 90% of your home’s appraised value minus your existing mortgage balance.

- Example: If your home is valued at $300,000 and you owe $150,000 on your current mortgage, you could potentially borrow up to $120,000 (90% of $300,000 is $270,000; $270,000 minus $150,000 equals $120,000).

2. Home Equity Line of Credit (HELOC)

- Typical Borrowing Limits: Usually up to 85% of your home’s appraised value minus your existing mortgage balance.

- Example: With a home valued at $300,000 and an existing mortgage of $150,000, you might be able to get a line of credit up to $127,500 (85% of $300,000 is $255,000; $255,000 minus $150,000 equals $105,000).

3. Cash-Out Refinance

- Typical Borrowing Limits: Typically up to 80% of your home’s appraised value, including the amount you owe on your existing mortgage.

- Example: If your home is worth $300,000 and you owe $150,000 on your mortgage, you might be able to refinance up to $240,000 (80% of $300,000), giving you $90,000 in cash after paying off the existing mortgage.

4. Personal Loan

- Typical Borrowing Limits: Usually range from $1,000 to $100,000, depending on your creditworthiness, income, and lender’s policies.

- Example: Many personal loans are capped around $20,000 to $50,000 for home improvements, but some lenders offer higher limits for borrowers with strong credit profiles.

5. Credit Card

- Typical Borrowing Limits: Credit limits vary widely based on your credit score, income, and credit history. They generally range from a few hundred dollars to several thousand dollars.

- Example: You might have a credit limit of $5,000 to $10,000 on a card, but using a card for large home improvement projects can be costly due to high interest rates.

6. FHA 203(k) Loan

- Typical Borrowing Limits: Depends on the value of the home and the scope of the renovation. The maximum loan amount is based on the after-renovation value of the property.

- Example: For a single-family home, the maximum FHA 203(k) loan limit varies by location and is often tied to local conforming loan limits.

7. VA Renovation Loan

- Typical Borrowing Limits: The loan amount is based on the cost of the home plus the renovation expenses, subject to VA loan limits for your area.

- Example: VA loan limits are determined by county and can vary. For instance, in higher-cost areas, the limit can be higher, allowing for more extensive renovations.

Factors Affecting Borrowing Limits:

- Home Equity: The more equity you have in your home, the higher the borrowing limit you might be eligible for.

- Credit Score: Higher credit scores often qualify for larger loan amounts and better terms.

- Income and Debt-to-Income Ratio: Lenders will consider your income and existing debt to determine how much you can afford to borrow.

- Lender Policies: Different lenders have varying criteria and maximum limits.

How to Maximize Borrowing Potential:

- Improve Your Credit Score: Higher credit scores can improve your chances of securing a larger loan.

- Increase Home Equity: Consider making additional mortgage payments to build equity before applying.

- Shop Around: Compare offers from multiple lenders to find the best borrowing limits and terms.

The typical borrowing limits for different home improvement loans and considering your financial situation, you can choose the best loan option to meet your project needs.

What Are the Options And Pros and Cons Between Construction Loans, Mortgage Loans, and Home Improvement Loans?

When financing a home improvement or construction project, it’s important to understand the differences between construction loans, mortgage loans, and home improvement loans. Each type has its own advantages and disadvantages, depending on the scope and nature of your project. Here’s a detailed comparison:

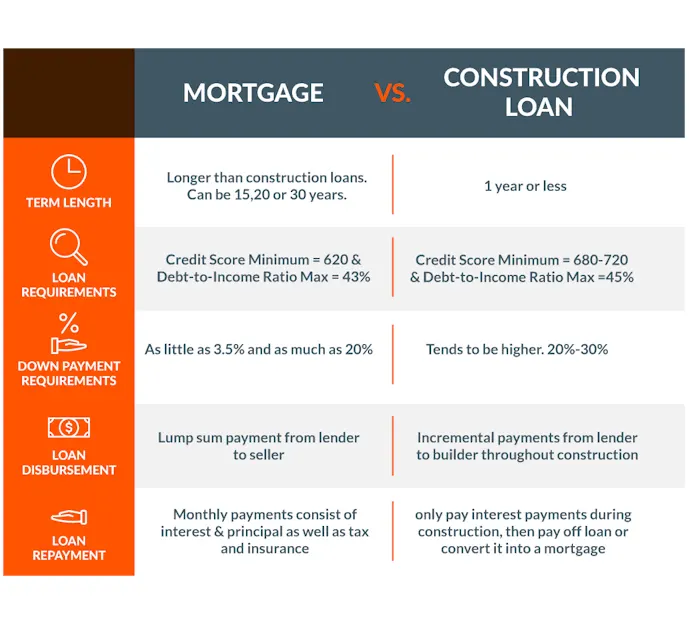

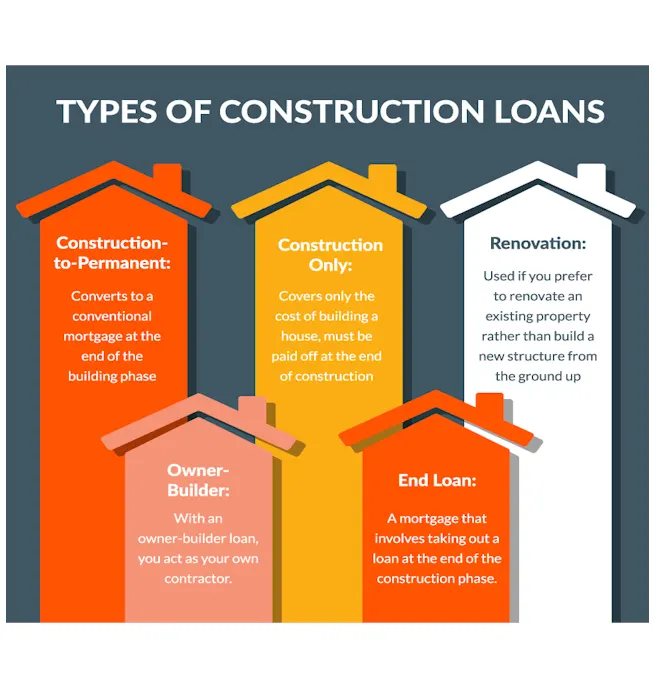

1. Construction Loans

Overview: Construction loans are short-term loans specifically designed to cover the costs of building a new home or major renovations. They typically cover the construction phase and are converted to a long-term mortgage once the project is completed.

Pros:

- Flexibility: Designed for new construction or major renovations, offering funds based on the construction progress.

- Disbursement: Funds are disbursed in stages as the construction progresses, which can help manage cash flow.

- Interest Rates: Generally lower than personal loans or credit cards.

Cons:

- Short-Term Nature: Typically short-term (6 to 12 months) with higher interest rates than traditional mortgages.

- Complex Process: Often involves more paperwork and a more complex approval process.

- Requires Completion: Requires the project to be completed and approved before converting to a long-term mortgage.

Best For: Building a new home or undertaking significant renovations where construction needs to be financed in stages.

2. Mortgage Loans

Overview: Mortgage loans are long-term loans used to purchase or refinance a home. They can also be used for home improvements if you opt for a cash-out refinance.

Pros:

- Long-Term Financing: Typically offers long repayment terms (15 to 30 years), which can lower monthly payments.

- Lower Interest Rates: Generally have lower interest rates compared to other loan types due to being secured by the home.

- Tax Benefits: Mortgage interest may be tax-deductible.

Cons:

- Secured Loan: The loan is secured by your home, which means there is a risk of foreclosure if you default.

- Long Approval Process: Approval and closing can be time-consuming.

- Not Ideal for Small Projects: Best suited for purchasing a home or large-scale refinancing rather than minor home improvements.

Best For: Purchasing a new home or refinancing an existing mortgage. Can be used for home improvements through cash-out refinancing.

3. Home Improvement Loans

Overview: Home improvement loans are specifically designed to fund renovations and repairs. They come in various forms, including home equity loans, home equity lines of credit (HELOCs), personal loans, and credit cards.

Pros:

- Tailored for Renovations: Specifically designed to cover home improvement costs, making them ideal for minor to moderate renovations.

- Flexibility: Options like HELOCs offer flexibility in borrowing and repaying funds as needed.

- No Home Equity Required: Personal loans and credit cards do not require home equity.

Cons:

- Higher Interest Rates: Personal loans and credit cards often have higher interest rates compared to home equity loans and HELOCs.

- Shorter Terms: Personal loans typically have shorter repayment terms, which can lead to higher monthly payments.

- Variable Rates: HELOCs often have variable interest rates, which can fluctuate and impact your payments.

Best For: Minor to moderate home improvements or repairs where a specialized loan can provide the necessary funds without the need for large-scale construction.

Summary of Options

- Construction Loans: Ideal for new builds or major renovations with a focus on managing construction expenses in phases. Offers flexibility but involves a complex process and short-term nature.

- Mortgage Loans: Best for purchasing or refinancing a home, including larger home improvement projects through cash-out refinancing. Provides long-term financing with lower interest rates but is not ideal for small-scale projects.

- Home Improvement Loans: Suitable for smaller renovation projects with options like home equity loans, HELOCs, personal loans, and credit cards. Provides flexibility but interest rates and terms vary widely.

Choosing the right loan depends on the scale of your project, your financial situation, and your long-term goals. By evaluating these factors and understanding the pros and cons of each loan type, you can select the option that best aligns with your needs.

How do you Assess Smartly the Needs and the Budget to get a Loan for Your Home Improvement Project

Assessing your needs and budget smartly is crucial for choosing the best loan for your home improvement project.

Here’s a step-by-step approach to ensure a thorough and effective evaluation:

1. Define Your Project Scope

- Detailed Estimates: Obtain detailed quotes or estimates from contractors for your home improvement project. Ensure these estimates cover all aspects of the project, including labor, materials, and any potential additional costs.

- Project Prioritization: List out all the desired improvements and prioritize them based on necessity and impact. This helps in managing the budget and deciding if the entire project or just certain elements can be financed.

2. Calculate Total Costs

- Include Contingency Funds: Add a contingency fund (typically 10-20% of the total project cost) to cover unexpected expenses or changes in scope. Home improvement projects often encounter unforeseen issues, and having a buffer ensures you’re not caught short.

- Factor in Additional Costs: Consider any costs related to permits, inspections, or potential upgrades to your home’s systems (like electrical or plumbing) that might be required as part of the project.

3. Evaluate Your Financial Situation

- Review Your Budget: Analyze your current budget to understand how much you can comfortably allocate for loan payments. Ensure that monthly payments will fit within your budget without compromising other financial obligations.

- Check Your Credit Score: Obtain your credit report and score to gauge the interest rates and loan terms you might qualify for. A higher credit score generally results in better loan terms.

4. Explore Financing Options

- Match Loan Types to Needs: Choose between different loan options based on your project size and financial situation. For large projects, home equity loans or cash-out refinances might be suitable. For smaller or ongoing projects, HELOCs or personal loans might be better.

- Compare Rates and Terms: Look at interest rates, fees, and repayment terms for each loan type. Fixed-rate loans offer stability, while ARMs or HELOCs offer flexibility but with potential for rate fluctuations.

5. Project Future Financial Impact

- Estimate Loan Repayments: Use online loan calculators to estimate monthly payments for each loan option. Factor in your current financial situation to determine if these payments are manageable.

- Consider Long-Term Costs: Evaluate how each loan type affects your long-term financial health, including any impact on your home’s equity and overall debt levels.

6. Consult Professionals

- Financial Advisor: Seek advice from a financial advisor to ensure you’re choosing a loan that aligns with your overall financial goals and capabilities.

- Contractor: Discuss your project with your contractor to confirm that your estimates are accurate and that you’re aware of any potential additional costs.

By meticulously defining your project needs, calculating comprehensive costs, and aligning your financing options with your financial situation, you can make an informed decision on the best loan for your home improvement project. This thoughtful approach helps ensure that you choose a loan that supports your project effectively while maintaining financial stability.

--- article sharing ---