January 26th, 2026

Using a loan calculator can help you find the best loan by allowing you to compare different loan options based on key factors like loan amount, interest rate, and loan term. Here’s a step-by-step guide:

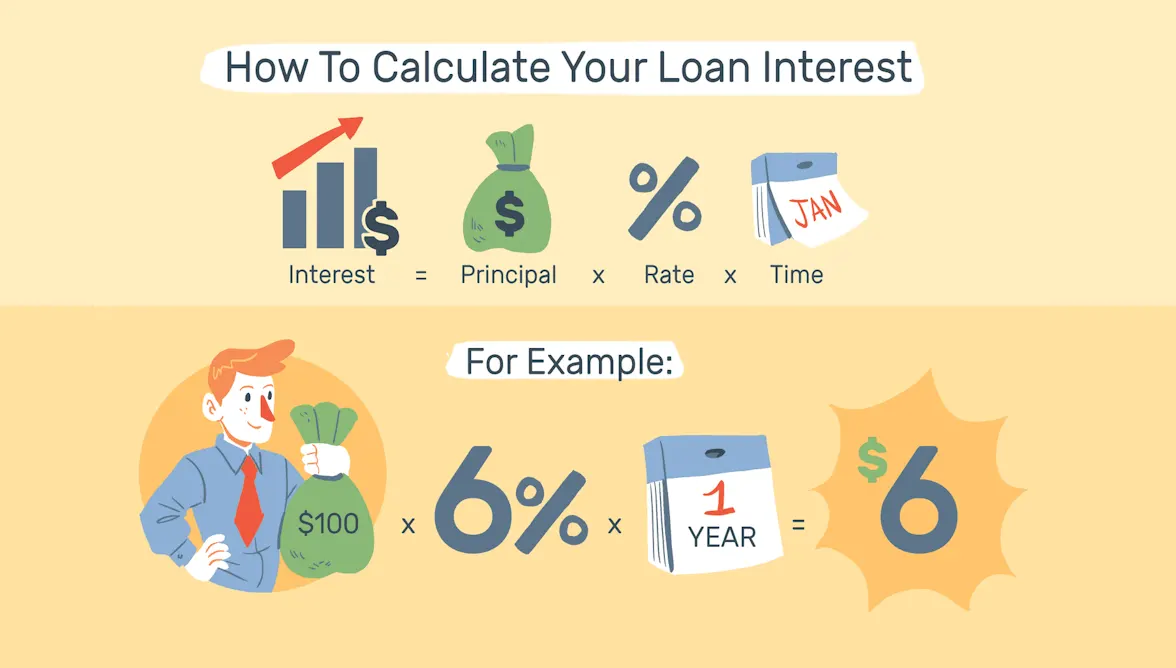

- Enter Loan Details: Input the loan amount you wish to borrow, the interest rate, and the loan term (in years or months). Some calculators also allow you to choose the type of interest (fixed or variable).

- Calculate Monthly Payments: The calculator will compute your estimated monthly payments based on the entered details. This helps you understand how much you’ll need to pay each month.

- View Total Interest: The calculator will also show the total interest you’ll pay over the life of the loan. This is crucial for comparing the overall cost of different loans.

- Amortization Schedule: Many calculators provide an amortization schedule, which breaks down each payment into principal and interest components. This helps you see how your loan balance decreases over time.

- Adjust Variables: Experiment with different loan amounts, interest rates, and terms to see how changes affect your monthly payments and total interest. This can help you find a loan that fits your budget and financial goals.

Using a loan calculator is a practical way to compare loan options and make informed decisions. You can find loan calculators on various financial websites.

Smartly Using a Loan Calculator to Find the Best Loan for You

Using a loan calculator is a powerful way to evaluate different loan options and find the best one for your needs. Here’s a step-by-step guide on how to effectively use a loan calculator:

1. Gather Loan Information

Before using a loan calculator, gather the following details:

- Loan Amount: The total amount you wish to borrow.

- Interest Rate: The annual percentage rate (APR) offered by the lender.

- Loan Term: The length of time over which you will repay the loan, typically in months or years.

- Repayment Frequency: Whether you’ll make monthly, bi-weekly, or weekly payments.

- Additional Fees: Any origination fees or other costs that may affect the total loan cost.

2. Choose the Right Loan Calculator

Select a loan calculator that matches the type of loan you’re evaluating. There are different calculators for:

- Fixed-Rate Loans: For loans where the interest rate remains constant throughout the term.

- Variable-Rate Loans: For loans where the interest rate may change periodically.

- Student Loans, Mortgages, Auto Loans: Specific calculators tailored for these types of loans.

3. Enter Loan Details

Input the gathered information into the loan calculator:

- Principal Amount: Enter the total loan amount.

- Interest Rate: Input the annual interest rate.

- Loan Term: Specify the length of the loan term.

- Repayment Frequency: Choose the payment schedule (e.g., monthly).

4. Analyze Monthly Payments

The calculator will provide you with:

- Monthly Payment: The amount you’ll need to pay each month to repay the loan.

- Total Interest Paid: The total interest you will pay over the life of the loan.

- Total Loan Cost: The total amount you’ll repay, including both principal and interest.

5. Compare Different Loan Options

Use the calculator to compare various loan scenarios:

- Change Loan Amount: See how altering the loan amount affects your monthly payment and total cost.

- Adjust Interest Rates: Compare the impact of different interest rates on your payments and overall cost.

- Modify Loan Terms: Evaluate how extending or shortening the loan term influences your monthly payments and total interest paid.

6. Evaluate the Impact of Fees

If your loan has additional fees, such as origination or processing fees:

- Add Fees to Principal: Adjust the loan amount in the calculator to include these fees, or use an advanced calculator that allows you to input fees separately.

- Recalculate: Assess how these fees affect your total loan cost and monthly payments.

7. Consider Prepayment Options

Some calculators allow you to evaluate the effect of making extra payments:

- Add Extra Payments: Input additional payments you plan to make, either as a lump sum or as additional monthly payments.

- Assess Savings: Determine how extra payments will reduce the loan term and the total interest paid.

8. Review the Results

Examine the results provided by the calculator:

- Affordability: Ensure the monthly payment fits within your budget.

- Total Cost: Check if the total cost of the loan is acceptable based on your financial goals.

- Comparison: Compare results from different loan scenarios to determine the most cost-effective option.

9. Make an Informed Decision

Based on the calculator’s results:

- Choose the Best Option: Select the loan with the most favorable terms, including manageable monthly payments and a reasonable total cost.

- Consult Lenders: If needed, reach out to lenders to clarify terms and confirm the details of the loan offers.

10. Use Additional Tools

In addition to loan calculators, consider using:

- Amortization Schedules: To see a breakdown of each payment, including principal and interest.

- Loan Comparison Tools: To compare different loan products side-by-side.

By following these steps, you can effectively use a loan calculator to evaluate your options and choose the best loan for your financial needs.

Clever secrets and insights into Using a Loan Calculator

When using a loan calculator to find the best loan for you, it’s crucial to approach the process with a discerning eye to avoid falling for marketing tricks employed by lenders. Here are some clever secrets and insights to help you leverage a loan calculator effectively and make informed decisions:

1. Understand the True Cost of Borrowing

Secret Insight: Loan calculators provide a clear picture of the total cost of borrowing, including monthly payments and total interest paid. Marketing materials from lenders may highlight low monthly payments to attract borrowers but often obscure the total cost of the loan. By using a loan calculator, you can directly compare the total cost of different loans, not just the monthly payment, and avoid falling for marketing tactics that emphasize lower payments while extending the loan term.

2. Compare Apples to Apples

Secret Insight: Lenders may offer various features and promotions that can be misleading. A loan calculator allows you to input exact terms from different lenders—such as interest rates, loan amounts, and terms—to ensure you’re comparing similar products. This prevents confusion caused by promotional offers or complex loan features that can obscure the true cost.

3. Beware of Teaser Rates

Secret Insight: Some loans come with low introductory or teaser rates that may increase significantly after an initial period. Loan calculators can help you model these scenarios by allowing you to input different rates over time, giving you a clearer picture of how the rate changes will impact your payments and total cost. This helps you avoid loans with deceptive initial rates that can lead to much higher costs down the road.

4. Account for Fees and Costs

Secret Insight: Lenders often advertise loans without fully disclosing all associated fees, such as origination fees or closing costs. A comprehensive loan calculator that allows you to add these fees to the loan amount will give you a more accurate representation of the total cost. This insight helps you avoid loans with hidden costs that might not be apparent in initial marketing materials.

5. Evaluate Different Scenarios

Secret Insight: Use the loan calculator to simulate different scenarios, such as varying loan amounts, interest rates, and terms. This enables you to see how changes in these variables affect your payments and total cost, allowing you to make better-informed decisions rather than being swayed by a lender’s marketing emphasis on a particular loan product.

6. Assess Impact of Prepayments

Secret Insight: Many lenders promote flexibility in repayment, but the real benefits of making extra payments or paying off the loan early might not be clear without a calculator. Use the calculator to input extra payments and see how they reduce your total interest and shorten the loan term. This helps you understand the real financial benefits of prepaying a loan, countering any marketing claims that might underemphasize these advantages.

7. Focus on Long-Term Financial Impact

Secret Insight: Lenders often highlight short-term benefits, such as low initial payments, without emphasizing the long-term impact on your finances. By examining the total interest paid and the overall cost of the loan using a calculator, you can better understand the full financial impact over the life of the loan, rather than being swayed by attractive short-term marketing messages.

8. Verify Lender Claims

Secret Insight: Marketing materials can be persuasive but may not always accurately reflect the terms of the loan. Use the loan calculator to verify claims about interest rates, monthly payments, and total costs. If a lender advertises low payments or special features, double-check these claims using the calculator to ensure they align with the actual loan terms.

9. Consider the Entire Loan Package

Secret Insight: Lenders may bundle loans with additional features, such as payment protection plans or discounts for autopay, which can seem appealing but may not always be necessary. Use the calculator to assess the basic loan terms and compare them without additional features to determine the core cost of borrowing. This approach helps you identify whether the extra features are worth their cost or if they are used to distract from less favorable loan terms.

10. Consult Multiple Sources

Secret Insight: Don’t rely solely on one lender’s marketing materials. Use the loan calculator to compare offers from multiple lenders and financial institutions. This approach ensures you have a comprehensive view of your options and can make an informed decision based on a broad comparison rather than being influenced by one lender’s promotional tactics.

By applying these secrets and insights, you can use a loan calculator effectively to uncover the true cost of borrowing and make more informed decisions, safeguarding yourself against potential marketing tricks and hidden costs from lenders.