When considering a loan, understanding the difference between secured and unsecured loans is crucial for making informed financial decisions.

What Are Secured Loans?

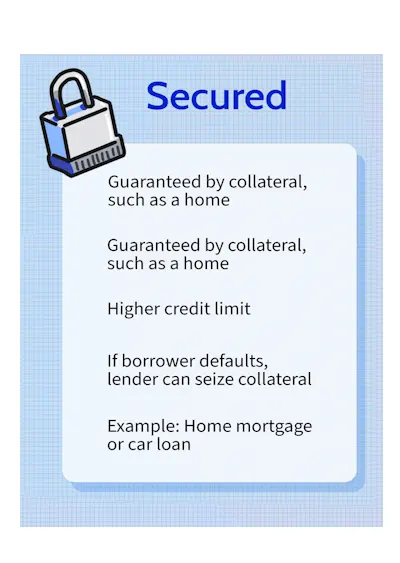

A secured loan is a type of borrowing where the lender requires the borrower to pledge specific assets as collateral. The collateral is typically related to the purpose of the loan.

For instance, in an auto loan, the vehicle being financed serves as collateral. Similarly, in a mortgage, the property purchased with the loan funds acts as security.

If the borrower fails to repay the loan or defaults, the lender has the right to seize the collateral to recover the outstanding balance. To protect the collateral, lenders often require that the asset be properly maintained and insured.

For example, with mortgages and auto loans, lenders might mandate specific types of insurance to cover the value of the asset. This insurance ensures that in the event of an accident, fire, or natural disaster, the lender can recoup the loan amount through insurance claims.

What Are Unsecured Loans?

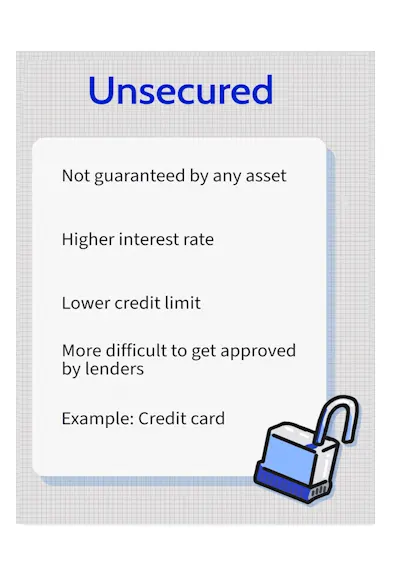

An unsecured loan does not require collateral, meaning it is not backed by any physical asset. Instead, lenders rely on the borrower’s creditworthiness and their promise to repay the loan according to the agreed terms.

Due to the absence of collateral, unsecured loans carry a higher risk for lenders. Consequently, they are more cautious in evaluating borrowers’ credit histories, seeking those with a strong record of timely payments, a clean credit history, and robust financial stability.

Because unsecured loans pose a greater risk to lenders, they generally come with higher interest rates compared to secured loans.

The lack of collateral means that if the borrower defaults, the lender faces a higher risk of losing the outstanding balance.

However, some unsecured loans, such as Treasury bills, might have lower interest rates despite lacking collateral. In these cases, investors rely on the government’s ability to generate revenue through taxes rather than any specific asset.

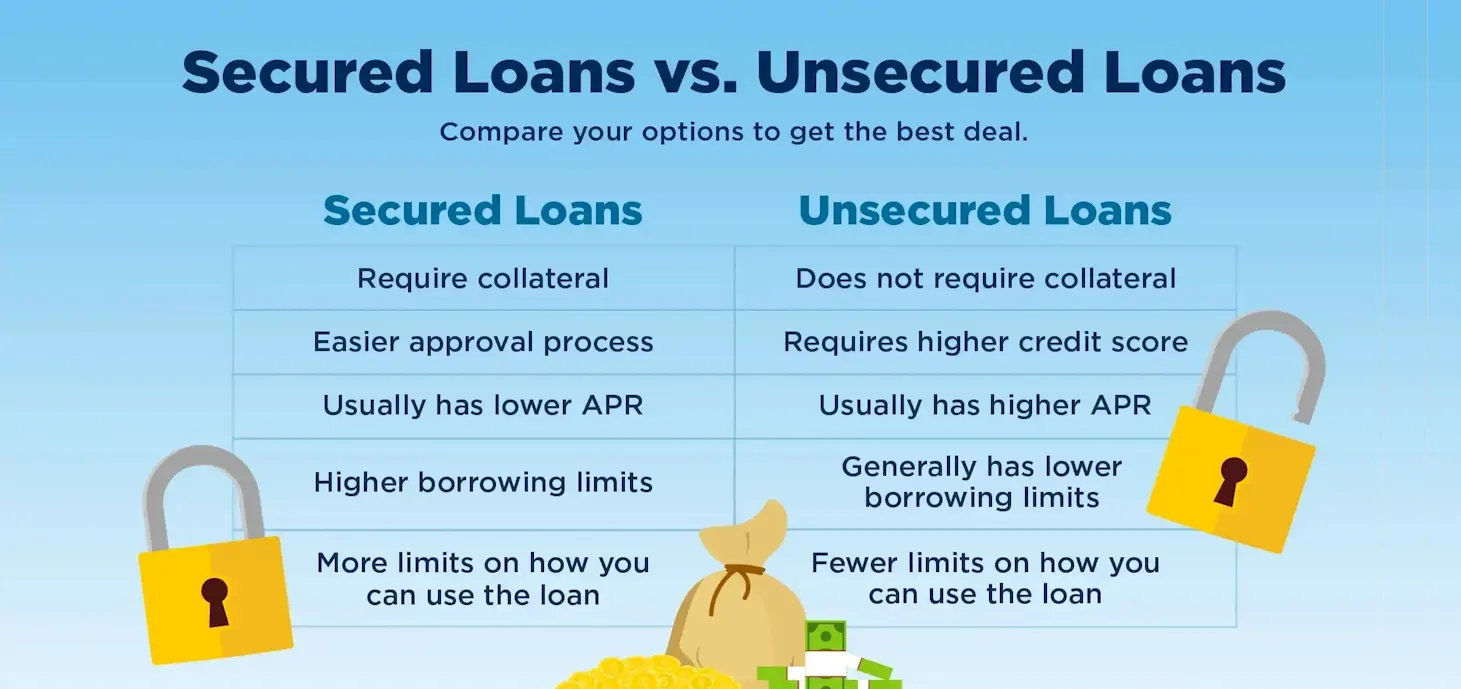

Here’s a more detailed review of the key aspects of both types of loans:

Secured Loans

Definition: A secured loan is backed by collateral—an asset that the borrower pledges as security for the loan. If the borrower fails to repay the loan, the lender has the right to seize the collateral to recover the owed amount.

Common Examples:

- Mortgage Loans: The home itself serves as collateral.

- Auto Loans: The vehicle being financed is the collateral.

- Home Equity Loans: The borrower’s home equity is used as collateral.

- Secured Credit Cards: A deposit made by the borrower serves as collateral.

Advantages:

- Lower Interest Rates: Secured loans generally offer lower interest rates compared to unsecured loans due to the reduced risk for lenders.

- Higher Borrowing Limits: Lenders may be willing to offer higher loan amounts when secured by valuable collateral.

- Easier Approval: Borrowers with less-than-perfect credit might find it easier to qualify for a secured loan because the collateral reduces the lender’s risk.

Disadvantages:

- Risk of Loss: If the borrower defaults on the loan, they risk losing the collateral, which can be a significant financial or personal asset.

- Collateral Requirement: Securing a loan requires having an asset to pledge, which may not be available for all borrowers.

- Complexity: The process of valuing and securing collateral can add complexity to the loan agreement.

Unsecured Loans

Definition: An unsecured loan does not require collateral. Instead, approval is based on the borrower’s creditworthiness, income, and other financial factors.

Common Examples:

- Personal Loans: Often used for a variety of purposes like debt consolidation, medical expenses, or vacations.

- Credit Cards: Revolving credit that doesn’t require collateral.

- Student Loans: Typically do not require collateral and are based on the borrower’s creditworthiness and ability to repay.

- Medical Loans: Used to cover medical expenses without collateral.

Advantages:

- No Collateral Required: Borrowers do not need to pledge assets, which means there is no risk of losing personal property if the loan is not repaid.

- Simpler Process: The application and approval process can be less complex since there’s no need to appraise or secure collateral.

- Flexibility: Unsecured loans are often used for a variety of purposes, and borrowers can generally use the funds as needed.

Disadvantages:

- Higher Interest Rates: Because there is no collateral, unsecured loans typically come with higher interest rates to compensate for the increased risk to lenders.

- Lower Borrowing Limits: The amount available to borrow is often lower compared to secured loans due to the lack of collateral.

- Stricter Approval Criteria: Approval can be more challenging for borrowers with poor credit histories, as lenders rely heavily on credit scores and income.

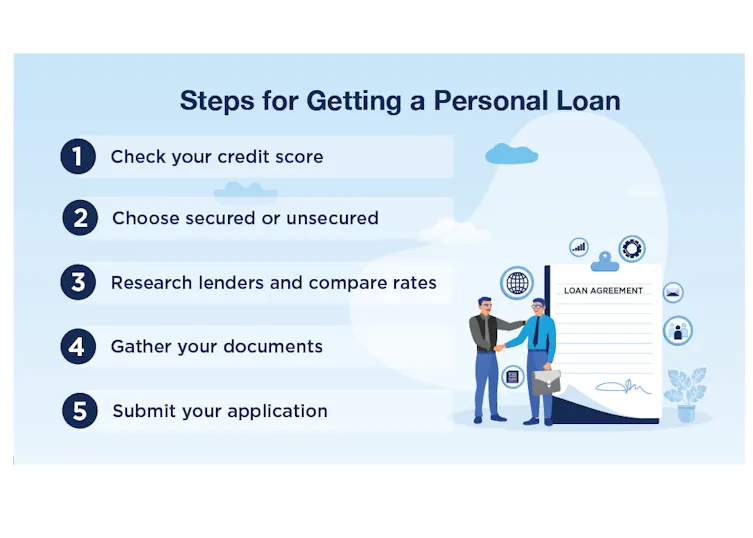

Choosing Between Secured and Unsecured Loans

Considerations:

- Purpose of the Loan: Determine whether you need a large sum of money or a smaller amount. Secured loans are often better for larger amounts, while unsecured loans are suitable for smaller needs.

- Risk Tolerance: Evaluate your willingness to risk personal assets. If you’re not comfortable putting up collateral, an unsecured loan might be preferable.

- Credit Profile: Your credit score and financial situation play a significant role. A strong credit profile might make it easier to qualify for an unsecured loan, while a weaker profile might make a secured loan more accessible.

- Interest Rates: Compare the interest rates and overall cost of borrowing. Secured loans usually offer lower rates, but assess whether the potential loss of collateral outweighs the interest savings.

The primary sources for personal loans are banks, credit unions, and online lenders, each with its own set of requirements and loan types.

Banks generally have stricter qualifications, often requiring collateral for certain loans such as auto loans, equipment loans, working capital loans, and mortgages.

They may also necessitate proof of employment and business cash flows for these types of secured loans.

Credit unions, on the other hand, tend to have more flexible lending criteria. Borrowers must be members of the credit union to access its loan products, but for smaller loan amounts, credit unions may focus on the borrower’s credit score rather than requiring collateral.

Online lenders primarily offer unsecured loans, typically for smaller amounts. They usually evaluate borrowers based on their credit history and score, and do not require collateral.

This makes online lenders more accessible for individuals with strong credit profiles seeking quick, smaller loans without the need to pledge assets.

Both secured and unsecured loans have their advantages and disadvantages, and the best choice depends on individual financial needs, risk tolerance, and creditworthiness.

Secured loans provide lower rates and higher borrowing limits but come with the risk of losing collateral.

Unsecured loans offer greater flexibility and no risk to personal assets but often come with higher rates and stricter approval criteria. Carefully consider your financial situation and goals before deciding which type of loan is right for you.

U.S, Financial Institutions that focus on Secured and/or Unsecured loans for consumers and businesses

Here is a list of 50 lending companies in the U.S. that specialize in secured or unsecured loans. This list includes a mix of banks, credit unions, and online lenders offering various types of loans:

Banks:

- JPMorgan Chase – Offers personal loans, auto loans, and mortgages.

- Bank of America – Provides secured and unsecured personal loans, home loans, and auto loans.

- Wells Fargo – Offers personal loans, home equity loans, and auto loans.

- Citibank – Provides personal loans, auto loans, and home equity loans.

- Capital One – Specializes in unsecured personal loans and auto loans.

- PNC Bank – Offers personal loans, auto loans, and home equity lines of credit.

- HSBC – Provides personal loans and home equity loans.

- U.S. Bank – Specializes in personal loans, home equity loans, and auto loans.

- TD Bank – Offers personal loans, home equity loans, and auto loans.

- SunTrust (now Truist) – Provides personal loans, home equity loans, and auto loans.

Credit Unions:

- Navy Federal Credit Union – Specializes in personal loans, auto loans, and home equity loans.

- PenFed Credit Union – Offers personal loans, auto loans, and home equity loans.

- Credit Union of America – Provides personal loans, auto loans, and home equity loans.

- State Employees’ Credit Union – Specializes in personal loans, auto loans, and home equity loans.

- Alliant Credit Union – Offers personal loans and auto loans.

- USAA – Provides personal loans, auto loans, and home equity loans.

- Boeing Employees Credit Union – Specializes in personal loans and auto loans.

- First Tech Federal Credit Union – Offers personal loans and auto loans.

- Suncoast Credit Union – Provides personal loans, auto loans, and home equity loans.

- SchoolsFirst Federal Credit Union – Specializes in personal loans and auto loans.

Online Lenders:

- LendingClub – Offers unsecured personal loans.

- Prosper – Provides unsecured personal loans.

- SoFi – Specializes in unsecured personal loans, student loans, and home loans.

- Upstart – Offers unsecured personal loans.

- Avant – Provides unsecured personal loans.

- Marcus by Goldman Sachs – Specializes in unsecured personal loans.

- Kabbage – Offers business loans and lines of credit.

- OnDeck – Provides unsecured business loans and lines of credit.

- Funding Circle – Specializes in unsecured business loans.

- BlueVine – Offers business lines of credit and invoice factoring.

- Payoff – Provides unsecured personal loans for debt consolidation.

- Affirm – Specializes in point-of-sale financing and unsecured personal loans.

- Earnest – Offers unsecured personal loans and student loan refinancing.

- CommonBond – Provides student loan refinancing and personal loans.

- Credible – Specializes in personal loan comparison and refinancing.

- LightStream – Offers unsecured personal loans for various purposes.

- Best Egg – Provides unsecured personal loans.

- OneMain Financial – Specializes in secured and unsecured personal loans.

- Fiona – Offers unsecured personal loan comparison.

- LendingTree – Provides personal loan comparison and marketplace.

Specialized Lenders:

- Rocket Mortgage – Specializes in home mortgages.

- Caliber Home Loans – Provides home mortgages and refinancing.

- Quicken Loans – Offers home mortgages and refinancing.

- Figure – Specializes in home equity lines of credit and personal loans.

- Mr. Cooper – Provides home mortgages and refinancing.

- AmeriSave Mortgage – Offers home mortgages and refinancing.

- New American Funding – Specializes in home mortgages and refinancing.

- Fairway Independent Mortgage – Provides home mortgages and refinancing.

- Flagstar Bank – Offers personal loans, home mortgages, and auto loans.

- Regions Bank – Specializes in personal loans, home mortgages, and auto loans.

This list covers a range of options from traditional banks and credit unions to modern online lenders, each offering various types of secured and unsecured loans to suit different financial needs.

--- article sharing ---