July 13th, 2025

Emergency loans are financial products designed to provide quick access to funds when an unexpected expense arises, such as medical emergencies, car repairs, or urgent home repairs.

These loans are typically sought when traditional savings or other financial resources are insufficient.

One common example is a personal loan, which can be unsecured (not requiring collateral) or secured (requiring collateral like a car or home).

For instance, if your car breaks down and you need immediate repair to commute to work, a personal loan might be an appropriate solution.

These loans usually offer a fixed interest rate and a set repayment term, making them a manageable option for many borrowers.

Emergency Loans: Access Quick Funding

Accessing quick funding through emergency loans can be crucial when unexpected expenses arise.

To access emergency funding, it’s essential first to evaluate your financial needs and explore various loan options available.

This includes payday loans, which are short-term, high-interest loans designed to be repaid with your next paycheck.

While they offer quick access to cash, they often come with high fees and can lead to a cycle of debt if not managed carefully.

Also, credit card cash advances allow you to borrow against your credit limit, but they also come with high interest rates and fees.

For those with good credit, peer-to-peer lending platforms provide another option, connecting borrowers with individual investors who fund their loans, often with competitive interest rates.

Here’s a comprehensive guide to help you navigate the process:

1. Assess Your Needs

- Determine the Amount Needed: Calculate the exact amount you need to cover your emergency.

- Evaluate Your Ability to Repay: Consider your income and expenses to ensure you can manage the repayment.

2. Explore Loan Options

- Personal Loans: Offered by banks, credit unions, and online lenders. These can be unsecured or secured, with terms typically ranging from 1 to 7 years.

- Payday Loans: Short-term loans with high interest rates, usually to be repaid by your next paycheck. These are risky due to high costs and potential for debt cycles.

- Credit Card Cash Advances: Allows you to withdraw cash using your credit card. Be aware of high interest rates and fees.

- Title Loans: Secured by your vehicle’s title, these can be risky as you may lose your car if you default.

- Peer-to-Peer Loans: Facilitated by platforms connecting borrowers with individual investors. Terms and rates vary.

3. Check Eligibility Requirements

- Credit Score: Your credit score affects loan terms and approval chances. Higher scores generally get better rates.

- Income and Employment: Lenders will often require proof of stable income and employment.

- Debt-to-Income Ratio: Lenders assess your ability to manage new debt relative to your existing debt and income.

4. Compare Lenders

- Interest Rates: Look for competitive rates and consider both APR (annual percentage rate) and interest rates.

- Fees: Be aware of any application fees, origination fees, or prepayment penalties.

- Repayment Terms: Understand the loan term and schedule to ensure it fits within your budget.

- Customer Reviews: Research lender reputations and customer service quality.

5. Prepare Your Documents

- Identification: Government-issued ID, such as a driver’s license or passport.

- Proof of Income: Pay stubs, tax returns, or bank statements.

- Proof of Residence: Utility bills or lease agreements.

- Credit History: Some lenders may pull your credit report, so be aware of your credit standing.

6. Apply for the Loan

- Online Applications: Many lenders offer online applications for faster processing.

- In-Person Applications: Visiting a bank or credit union may provide more personalized assistance.

- Provide Accurate Information: Ensure all information is complete and accurate to avoid delays.

7. Review Loan Terms Carefully

- Understand All Terms: Read the loan agreement thoroughly, including interest rates, fees, and repayment schedule.

- Ask Questions: Clarify any terms or conditions that are unclear.

8. Receive Funds

- Disbursement: Funds may be provided via check, direct deposit, or electronic transfer.

- Timing: Quick loans can often be processed within 24-48 hours, but timing varies by lender.

9. Repay the Loan

- Follow the Schedule: Make payments on time to avoid late fees and damage to your credit score.

- Consider Automatic Payments: Setting up automatic payments can help ensure timely repayment.

10. Manage Your Finances

- Budget: Adjust your budget to accommodate the new loan payment.

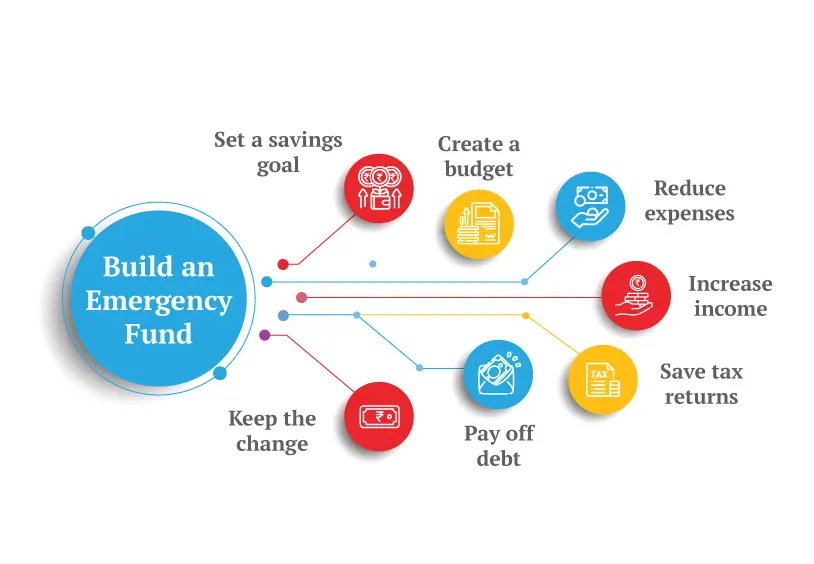

- Avoid Future Debt: Aim to build an emergency fund to prevent the need for loans in the future.

Emergency loans can provide crucial support in times of need, but it’s important to choose carefully and understand the implications of borrowing.

The application process for emergency loans involves gathering necessary documentation and comparing lenders to ensure the best terms.

Typically, you will need to provide identification, proof of income, and possibly a credit report. It’s crucial to review all loan terms, including interest rates, fees, and repayment schedules, to avoid any surprises.

For example, if you apply for a loan online through a lender with a fast approval process, you might receive funds within 24 to 48 hours, which can be vital in urgent situations.

However, ensure you fully understand the terms and are prepared for the repayment schedule to avoid financial strain in the future.

If possible, explore all options and select the one that best fits your financial situation.

Exploring Loan Options and Determining Eligibility

Exploring loan options and determining eligibility is a crucial step in securing the right financial assistance for your needs.

Here’s a few tips to help you navigate this process effectively:

1. Identify Your Loan Needs

- Define the Purpose: Clearly understand why you need the loan. Whether it’s for medical expenses, home repairs, or debt consolidation, the purpose will influence the type of loan you should consider.

- Calculate the Amount: Estimate how much money you need. This helps in finding loan options that match your requirement and avoids borrowing more than necessary.

2. Research Different Loan Types

- Personal Loans: These can be unsecured or secured and are offered by banks, credit unions, and online lenders. Unsecured loans don’t require collateral but may have higher interest rates. Secured loans, backed by collateral, typically have lower rates.

- Payday Loans: Designed for short-term needs and typically repaid on your next payday. They offer quick access to funds but come with high interest rates and fees, making them risky.

- Credit Card Cash Advances: Allows borrowing against your credit card limit. It’s convenient but usually comes with high interest rates and fees.

- Peer-to-Peer Loans: Facilitated by online platforms that connect borrowers with individual investors. These can offer competitive rates but require a good credit score and thorough application process.

- Title Loans: Secured by your vehicle’s title. While they offer fast access to cash, they can be risky as failing to repay could result in losing your vehicle.

3. Assess Lender Options

- Traditional Banks and Credit Unions: Often provide personal loans with competitive rates and terms, but may have stricter eligibility criteria and longer processing times.

- Online Lenders: Offer a range of loan products with quick approval processes. They may be more flexible but vary widely in terms of fees and interest rates.

- Peer-to-Peer Platforms: Provide an alternative with potentially lower rates but may require a more detailed application and a good credit score.

4. Check Eligibility Requirements

- Credit Score: Your credit score impacts the types of loans available to you and the interest rates you’ll receive. Higher scores typically qualify for better terms. Obtain a copy of your credit report and check for any issues that might affect your application.

- Income Verification: Lenders require proof of stable income to ensure you can repay the loan. This could include pay stubs, tax returns, or bank statements.

- Employment Status: A steady job or reliable source of income is crucial for most lenders. Some may have specific requirements regarding the length of employment.

- Debt-to-Income Ratio: Lenders assess your ability to manage new debt in relation to your existing debt. A lower debt-to-income ratio generally makes you a more favorable borrower.

5. Compare Loan Terms and Conditions

- Interest Rates: Compare APRs (Annual Percentage Rates) among different lenders. Lower rates are preferable, but ensure you understand whether they are fixed or variable.

- Fees: Look for application fees, origination fees, and prepayment penalties. Some lenders may offer no-fee loans but check if the interest rate compensates for this.

- Repayment Terms: Evaluate the length of the loan term and the payment schedule. Shorter terms may have higher monthly payments but lower overall interest costs, while longer terms offer lower payments but may cost more over time.

6. Apply for Pre-Approval

- Pre-Approval Process: Many lenders offer pre-approval, which provides a tentative loan amount and terms based on a preliminary review of your financial information. This helps gauge your eligibility without a hard credit inquiry.

- Submit Documents: Provide necessary documentation to complete the pre-approval process. This typically includes identification, proof of income, and possibly a credit report.

By thoroughly exploring loan options and understanding eligibility requirements, you can make an informed decision and select a loan that best suits your financial situation and needs.

Secrets offered by insider industry experts regarding Emergency Loans

Accessing quick funding through emergency loans can be crucial in a financial pinch, but it’s essential to navigate this process carefully to avoid common pitfalls.

Industry insiders offer several key insights to help you secure emergency loans effectively and minimize potential issues:

1. Understand the True Cost of Loans

- Look Beyond the APR: While the APR (Annual Percentage Rate) is a critical factor, it doesn’t always capture the full cost of borrowing. Insider tips suggest looking at all associated fees, including origination fees, application fees, and prepayment penalties. For example, a loan with a low APR might have high fees that can negate the benefit of a lower rate.

- Calculate the Total Repayment Amount: Use online calculators to estimate the total repayment amount over the life of the loan. This helps you understand how much you’ll end up paying in total, including interest and fees.

2. Leverage Your Credit Score Wisely

- Improve Your Score Before Applying: If you have time before needing the loan, improve your credit score by paying down existing debt, correcting errors on your credit report, and avoiding new credit inquiries. A higher credit score can qualify you for better rates and terms.

- Check for Pre-Qualification: Many lenders offer pre-qualification processes that allow you to see potential loan terms without impacting your credit score. This can help you compare options and find the best deal without a hard inquiry.

3. Choose the Right Type of Loan for Your Situation

- Evaluate Loan Types Thoroughly: Different emergency loans serve different purposes. For instance, personal loans are generally more flexible and offer lower interest rates compared to payday loans. Title loans might be a quick fix, but they come with significant risks. Industry experts recommend assessing the pros and cons of each type based on your financial situation.

- Consider Short-Term vs. Long-Term Needs: If you need immediate funds and can repay quickly, short-term options like payday loans might be feasible, though they come with high costs. For longer-term needs, a personal loan with a structured repayment plan might be more suitable.

4. Prepare for the Application Process

- Gather Documentation Ahead of Time: Having all necessary documents ready can speed up the application process. This typically includes identification, proof of income, and recent bank statements. Insiders recommend organizing these documents in advance to avoid delays.

- Be Honest and Accurate: Ensure all information provided in the application is accurate and complete. Misrepresenting your financial situation can lead to loan denial or issues later in the process.

5. Beware of Predatory Lending Practices

- Avoid Lenders with High Fees and Rates: Some lenders target individuals in financial distress with exorbitant fees and interest rates. Be cautious of offers that seem too good to be true or lenders that push you towards high-cost options without explaining the terms clearly.

- Read the Fine Print: Always read the loan agreement thoroughly, including all terms and conditions. Watch for clauses that might lead to unexpected costs or penalties, such as prepayment penalties or balloon payments.

6. Explore Alternative Funding Sources

- Consider Community Resources: Before taking out a loan, explore local community resources such as nonprofit organizations, charities, or government assistance programs. These can sometimes provide financial aid or support without the need for borrowing.

- Evaluate Personal Networks: If feasible, consider borrowing from friends or family. While this can be a sensitive topic, it often comes with more favorable terms and lower or no interest rates compared to formal loans.

7. Maintain Financial Discipline

- Stick to Your Budget: After securing an emergency loan, create a strict budget to manage your finances and ensure timely loan repayment. This helps avoid falling into further debt and maintains financial stability.

- Build an Emergency Fund: Once you’ve navigated through the immediate emergency, focus on building an emergency fund to reduce reliance on loans in the future.

By following these expert tips and insights, you can access emergency funding effectively while avoiding common pitfalls and ensuring that you secure the best possible loan terms for your needs.

--- article sharing ---