October 21st, 2024

At slower economic growth times, small to medium sized businesses have much higher demand for some kind of borrowing to help business growth, market share retention, and paying for the operating costs. Demand for small business loans increases dramatically.

As interest rates go up and remain high, cost of business operation increases, and loans for small businesses become critical as these businesses will find themselves in a position that they will now need loans for their business operations to continue, hence requiring cash flow loans or loans for growth.

The fact is that the entire global economy is built on credit and loans. While this is not going to change anytime in the near future, for sure, the sources for these loans are rapidly changing.

As the demand for loans increase, the number of businesses that can get approved for a loan from traditional sources such as banks, credit unions, and larger institutional lending sources will decrease because of the higher number of applicants and the risk associated to lending in less than optimum economic slowdown.

The larger more traditional lenders diversify to make sure that all their eggs are not in just one basket and will reduce risk in lending by investing more broadly than just in small businesses.

Hence, they often tend to tighten up what they will or won’t approve during times like these.

Lending criteria during high inflation and challenging economic times, get pretty tough if you wish to rely on larger banks and institutional lenders.

Add to that, the increase in new startups who also need to borrow to invest in their new idea or business venture and they usually rely heavily on loans, after the initial setup phase which they pay for, often, themselves or borrow from family members.

What Are Small Business Loans and What Options Are Available?

Let’s start by looking at the need for loans by small business owners and what’s available to them.

Recent 2024 government paper found that more Americans are starting new businesses than ever before.

In fact just in 2023-2024, Americans applied to start five and a half million new businesses each year – 20% more than any previous year on record.

Small businesses with fewer than 50 workers created 2.8 million jobs in 2024 – the highest rate of small business job creation ever recorded in a single year.

The U.S. Treasury Department periodically announces programs to help small to medium sized businesses aimed to assist growth and promote startups and small business entrepreneurship.

Some of the programs are intended to help as part of the American Rescue Plan, while others are meant to assist with cash flow and business assistance loans.

Exactly, What Is a Small Business Loan?

These are loans that are designed for small businesses and their specific circumstances and business objectives.

Lending institutions know that small businesses have different needs compared to larger corporations so they designed loan criteria based on these specific needs.

Small business loans help business make large equipment purchases, or other larger purchases such as marketing investment, and cover the cost of doing business.

Once loans are approved, the funds generally are issued as a lump sum (deposited in your business bank account) and can be used to make a specific purchase or manage cash flow and then repaid with interest.

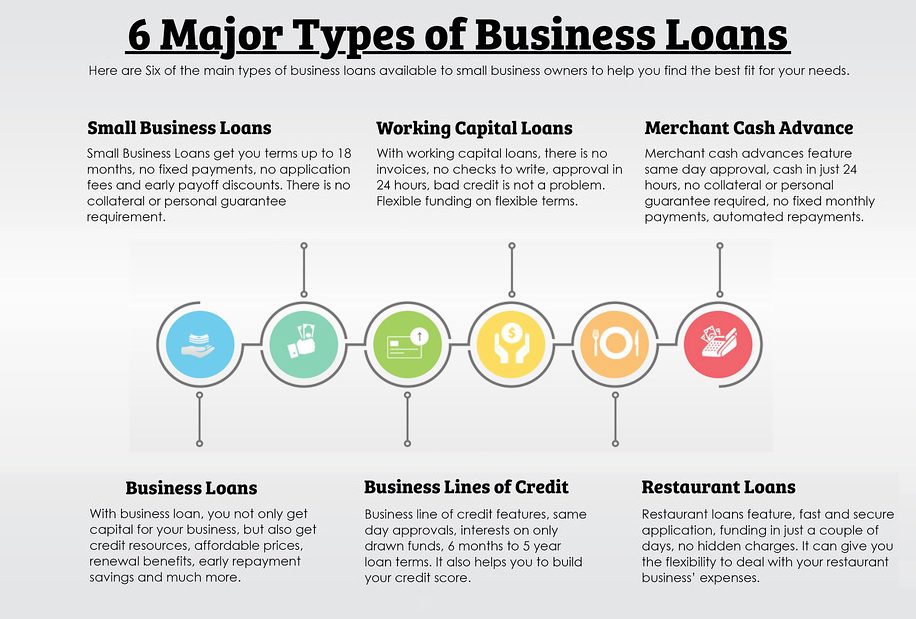

There are many types of small business loans, such as lines of credit, merchant cash advances and invoice financing.

Business owners use these often flexible funding options to access cash more quickly when their business needs it.

The best loan for a business depends on a number of factors, including its creditworthiness, how much it needs to borrow, what the funds will be used for and how quickly it needs access to loan proceeds.

When it comes to loans for small businesses, there are many options available.

In fact, sometimes it can be overwhelming to choose a small business loan.

But if you evaluate your business needs, you can narrow down the options until you can select the best loan for your specific circumstances.

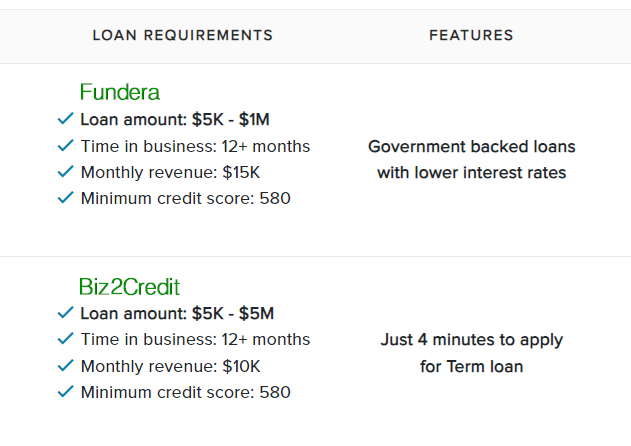

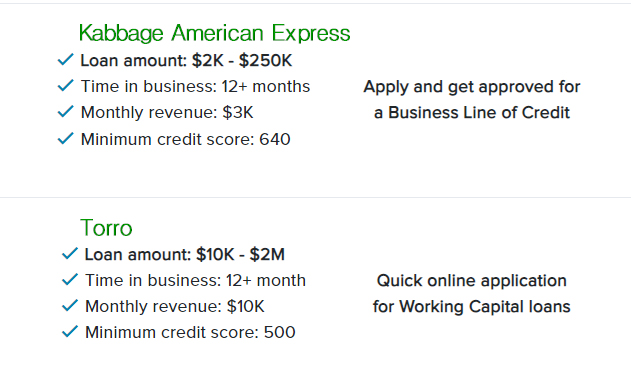

Do research on lenders that are eager to provide financing to see what interest rates, fees, loan amounts and terms are offered.

Loan business is a service for lending money and making money from lending. So, you can be confidence that eventually you find the best loan for your situation and get your business the money it needs to succeed.

1. Small Business Loans and Grants

If you’re a business owner who needs cash injection into your business for whatever purpose, be it increasing marketing or just cash flow needs, a small business loan can help you get to your goals.

But as you already know, it is important to select the right type of loan and the best options for your business and financing needs.

If you choose the wrong loan, you may get delayed for months to receive funds when you need them fast or even worse, you get the wrong type of loan, high interest rate, inflexible repayment options.

Most common business loans are from banks, credit unions, or Small Business Administration (SBA) loans.

But not everybody has a bank loan, not everybody has an SBA loan.

When it comes to small business funding, some individuals get loans from family members and yet others get loans from friends or neighbors.

Some are very creative and create a lending club and lend to one another.

Some people factor the receivables, recurring revenue based on monthly sales, some people have rigid cash advances, some people have hard money loans, and some people event take out an equity line of credit to inject capital into their business.

2. Small Business Loans for New Startup Businesses

If you’re just starting your new business business venture, small business loans can help you access the capital your business needs to thrive. Small business loans let eligible business owners borrow funds to cover company-related purchases and operating expenses.

3. Small Business Loans for Existing Businesses with no Revenue/Income

While traditional banks and credit unions typically offer a range of small business loans for smaller amounts, including those backed by the SBA there are far more smaller non-traditional lenders that offer some pretty interesting terms and programs.

Yes, it is true that small business owners may still find it easier to qualify at an institution where they have an existing banking relationship, and obtain the loan they want.

But this is not always the case. Traditional banks usually have the business’ financial statements on file, and as a result it may be easier to get approved.

But non-traditional lenders offer existing programs.

Many smaller and non-traditional lenders have more flexible borrower qualifications than larger, traditional banks and credit unions while offering APRs that are still very competitive.

Also, approval rates are much higher and borrowers are less likely to need collateral.

What’s more, many of these lenders provide faster funding, usually in half the time, than their traditional counterparts, making them a good option for businesses that need cash quickly.

4. Small Business Loans for Existing Businesses with Receivables

Receivables (as discussed below) are a great want to get loans as these offer great collateral, in the eyes of lenders.

These often short loans can be an effective way to access cash quickly to inject into a business that may not want to wait the usual 30 to 90 day it takes for customers usually have to pay invoices.

For that reason, loans based on receivables are a very helpful strategy when you need short-term financing to help manage cash flow for your business.

These loans provide short-term financing amounts between $10,000 to $5 million with APRs between 10% and in some cases as much as 80%. Yes, it’s high, but the lower tier amounts can be only as much as 20%.

5. Small Business Loans for Short Term Cash Flow Loans

These are again very similar to collateral-based receivables business loans.

You don’t usually need to put your business or personal assets on the line as collateral with a short-term loan or short-term cash advance, though.

If you have a high enough credit rating (usually above 600), you can get up to 3 times your monthly revenue. With higher credit rating, you can get as much as 6 times your monthly revenue.

It’s quick and easy to fund and inject capital into your business for growth.

6. Small Business Loans for Women-run Businesses

There are almost 1.2 million women-owned and operated small businesses in U.S., according to the most recent data from the U.S. Census Bureau.

There are now programs that are being offered for women-owned and operated businesses and these are designed to approve small business loans for women.

There are plenty of new program already available for women to get small business loans as well as resources like government-backed Women’s Business Centers offer training to help bridge the funding requirements and help these business owners

The right loan for your business is the one that costs you the least while fitting your company’s needs, whether you are a man or a woman.

However, women have had more problems in getting funding, traditionally speaking.

There are now many options for women startups and/or bad credit borrowers. There are also lots of grants and other programs for female entrepreneurs.

6.1 SBA for women run businesses

The SBA microloan program is designed specifically for women-owned startups and early-stage businesses (startups received 40% of all SBA microloans in fiscal year 2024). These are very flexible and offer great rates.

And then there is SBA Community Advantage loans typically go to businesses that have been in operation for fewer than three years.

SBA microloans are issued by nonprofit organizations and government and federal agencies. You can find these providers in your area on the local SBA website.

Additional funding options include small-business grants and crowdfunding.

If you have good personal credit, you may qualify for a personal loan for a women-owned business with unsecured loans as high as $100,000.

Grants

Women-owned businesses can get free funding through grants from government agencies and nonprofit organizations. Here are places to look for small-business grants for women:

– Women’s Business Centers

The Women’s Business Centers are a network of more than 100 educational centers around the United States that help women start and grow their businesses. These SBA-funded centers typically offer seminars and workshops on a range of topics, including how to start a business and raise capital.

– Federal contracting programs

The SBA-run Women-Owned Small Businesses Federal Contracting Program is for women-owned businesses that are interested in government contracts. Women can also apply for a certification from the SBA 8(a) Business Development program, which allows all “socially and economically disadvantaged people or entities” (including women) to compete for set-aside federal contracts.

– Ascent online learning platform

Ascent is a free digital tool launched in 2021 as part of a joint initiative between the White House, SBA, the U.S. Department of Labor’s Women’s Bureau and the U.S. Department of the Treasury. This online platform offers tools, quizzes and other learning resources designed to help women entrepreneurs who are looking to grow their businesses.

– National Association of Women Business Owners

The National Association of Women Business Owners, based in Washington, D.C., has 5,000 members and nearly 60 chapters across the country. It offers training and information on topics such as access to capital, government contracting and business certification.

– National Women’s Business Council

The National Women’s Business Council works with the Office of the President, Congress and the SBA on issues related to women business owners. Resources include help for startups, alternative lender programs, conferences and mentor groups.

7. Small Business Loans for Veterans

Our national heroes deserve the best from this nation.

Business loans for veterans can make it easier for current and former service members to start and grow their businesses.

In addition to offering loans specifically tailored to veterans, the U.S. Small Business Administration (SBA) provides 7(a) loans (described under SBA loans below) and resources to help thse businesses thrive.

When it comes to veterans, non-traditional lenders typically offer more favorable loans than banks and credit unions.

However, because most credit unions require memberships, they often offer additional member perks and discounts to their members, in particular credit unions that are based on our military organizations.

You typically won’t see these benefits at a bank or online lender.

Veterans also can apply for general business loans through traditional and online lenders and may qualify for veteran-specific grants that don’t require repayment.

SBA Veterans Advantage Program is a very unique program that reduces guaranty fees for certain types of SBA 7(a) loans going to veteran-owned small businesses.

The program was originally initiated in 2014 to offer fee relief under the SBA Express program and, after expiring in 2015, was replaced with the current savings structure.

Under the program, fee relief is available to small businesses that are at least 51% owned and controlled by honorably discharged veterans, service-disabled veterans, active duty military service member eligible for the military’s Transition Assistance Program (TAP), and reservists and/or active National Guard members.

Current spouse of any veteran, active duty service member, Reservist, National Guard member or the widowed spouse of a service member who died while in service or as a result of a service-connected disability also qualifies for this program.

8. Small Business Loans for Minorities

Minority business owners in historically underserved communities can access funding from a wide variety of lenders these days, including SBA lenders.

These usually fall under the category of lenders that are nonprofit organizations and specialty programs which allow minorities have more success with these options than applying for traditional business loans with banks and credit unions and other institutional investors.

Through the SBA Community Advantage loan program, nonprofit lenders and community development companies offer funding to minorities (including women-owner and operated small businesses), they do often target low-income and rural communities.

Many nonprofit lenders also offer microloans and other forms of business financing for women- and minority-owned businesses in their communities outside of the SBA loan program.

One of the leading lenders is Accion Opportunity Fund with nearly 80% of its clients are women, people of color or immigrants and other minorities.

Today, there are other lending institutions who see benefits in lending to minority-operated or owned small businesses.

For instance, Union Bank, distribute minority business loans through specialty lending programs.

Union Bank’s program offers loans and lines of credit to women-, veteran- and minority-owned businesses with more flexible qualifications than its standard business loans.

9. Small Business Loans For Bad Credit or No Credit Applicants

It is no longer sensible to deny loans on purely bad credit or no credit applications. There are many circumstances that allow for funding and hence lenders are providing competitive programs for this category of business owners.

When you have bad credit, you can still get a small business loan. That’s a fact.

This is because your credit score doesn’t matter as much as the overall financial health of your business, demand for your products/services, and how you run and operate your business.

Many lenders require a minimum credit score of 500, at least six months in business, and more than $30,000 in annual revenue.

Other than that, there are a huge list of lenders, including online lenders, that cater for this category.

10. Small Business Loans for Internet E-commerce Website Businesses

While e-commerce businesses typically have fewer startup and ongoing costs than traditional businesses with retail shop, almost any business owner can use financial assistance to start or grow an ecommerce website.

Hence there is a loan for these businesses as there are for others.

Whether you’re just starting an e-commerce business or you’re looking to expand, an e-commerce business loan can help cover your costs.

There are many business expenses associated to online, Internet, or e-commerce businesses including hosting, domain name purchasing, website design, dropshipping, reselling items, manufacturing products from raw materials, hiring staff, marketing your business, and daily operating expenses.

Existing e-commerce businesses often need funding to grow or expand too.

There are many lenders that would love to lend money to E-commerce businesses, but the most ideal types of loans are those with uncapped lending with fluctuating monthly sales that allow flexibility and speed of funding.

11. Unsecured Loans for Small Businesses

With higher amount small business loans, there are typically some form of personal or business collateral required.

These include real estate, equipment, cash in a savings account or other assets.

But if you don’t have collateral to pledge for the loan or don’t want to put personal assets on the line, you can find no-collateral business loan options.

These are flexible and still very viable.

However, their interest rates are often higher.

The actual rates depend on credit score and rating as well as the amount of loan required.

Unsecured business loans can be tougher to qualify for and may carry higher interest rates than secured loans, but they have less risk for borrowers.

12. Fast Loans for Small Businesses (Loans Funded within 24-48 hours of approval)

Fast business loans for small business owners can sometimes be the most crucial thing for a business.

These are available from online lenders in just 24 hours, and often have Interest rates higher than bank or SBA loans.

There are a lot non-traditional lenders that specialize in these, and some business loans are quicker to fund than others.

Although there may not be a standard definition for the term “fast business loan,” these loans are usually available from online lenders, who offer streamlined applications and funding within one to three business days.

They are getting more and more popular since Covid.

13. Term loans for Small Businesses

The most common type of small business loans, is the Term Loans. These are often a lump sum of cash, or a number of regular payments over a period of a few months to the business, that you repay over a fixed term.

Business term loans are typically available up to around $500,000, and annual percentage rates (APRs) start around 9%-12%.

The monthly repayments will most often be fixed and include interest on top of the principal balance, all combined and set up as an automated debt from the business account.

Business owners have the flexibility to use a term loan for cash flow, equipment purchasing or everyday business operating expenses.

If the business or the business owner has good credit rating, more reasonable lenders will be funding your loan.

Otherwise, if your credit rating is really bad, lenders may require bi-weekly payments. In either case, you’ll have to make these payments on a regular basis without any interruptions.

Failure to make timely payments could result in either your credit score or your business’s credit score taking a hit.

The higher the amount of the Term Loan amount, the higher the likelihood that you will need to use collateral to secure the term loan.

14. Small Business Administration (SBA) loans for funding small businesses

SBA provides a government guarantee or think of it like insurance on the commercial loans to small business.

Therefore, they have a broader credit box of what they can approve or not approve.

However, in essence, some of the most active SBA lenders are banks and they happen to have an SBA department and work with local SBA and SCORE offices to inject capital into small businesses locally.

But as a non-bank SBA lender, there’re relatively few entities available, especially in the middle of U.S. between the two coasts.

SBA Chapters (as they are called) tend to operate based on the SBA’s intention, often governed by the latest government agenda or programs passed by some federal or local government agency.

So there are many different options that may not be available for making traditional conventional commercial or business loans.

SBA uses its own guidelines as their their SBA credit policy to make decision on what give loans for and what not to, and how much loans will or will not be available.

Overall, many business owners do like to get loans from SBA Chapters.

14.1 SBA Advantages

The biggest advantage of SBA loans is that it may be one of the few options available to you at a reasonably priced interest rate. Almost all other lending options, be it banks, credit unions, hard money loans and emerging cash advances, factory receivables, business credit cards, equity lines, etc. are all offering loans with higher interest rates than SBA loans. Almost always.

SBA lending tends to be for all sorts of uses of proceeds, much broader than other ordinary traditional lending. You can do just about any business loan purpose, you can even buy another business.

On top of all of that, there are much longer repayment terms associated with SBA loans. And that’s really important from a monthly cash flow standpoint.

So instead of having a three- or five-year term with ordinary banks, you might have a ten-year term with that SBA loan.

Or if you’re buying real estate instead of having a 15 or maybe even a 20-year amortization, you’ll have a 25-year situation with an SBA loan. The longer the repayment term, the lower your monthly payment is going to be.

This makes a huge difference for a new startup or a growing small business looking for a long-term capitalization and repayment plan.

The most common types of SBA loans include:

- SBA 7(a) loans. With maximum loan amounts up to $5 million, the SBA 7(a) loan program is the SBA’s main offering. Loans are often used to purchase real estate but may also be used for working capital, debt refinancing and the purchase of business supplies. Current interest rates, as of Oct. 7, for SBA 7(a) loans range from 5.5% to 11.25%.

- SBA 504 loans. Available up to $5 million, SBA 504 loans must be used for major fixed assets, like existing buildings or land, new facilities and long-term machinery and equipment. As such, 504 loans may not be used for working capital, inventory or other common business uses. Rates on SBA 504 loans are lower than those imposed by the 7(a) program, and range from about 2.81% to 4%.

- SBA microloans. SBA microloans extend up to $50,000 and most commonly used for a $25k-$50k cash flow injection. These are intended to help small businesses start or grow. This may involve using the funds for working capital, inventory, machinery, equipment and other fixtures and supplies needed to do business. Rates typically range from 8% to 13%, but this varies by lender.

15. Business Lines of Credit Loans

It is important to note that business line of credit is very popular with business owners and is very similar to a credit card, but you would use it for your business.

Business lines of credit provide business owners with a revolving credit limit that you can generally access through a checking account, or through your debt card or your dedicated credit card assigned to the finds within the business line of credit.

In many cases, most business owners can spend up to the maximum credit limit, repay it, then withdraw more money.

They can take their time to pay it over a long period of time, or pay it as soon as they have the funds and want to repay the loan.

Business lines of credit are a very flexible and useful type of quick business loan, if you’re not sure of the exact amount of money you’ll need since you only incur interest charges on the amount you withdraw. and use for your business, on a project to project basis or capital expenditure.

For some businesses this is a more viable option than, say Term loans, since a term loan requires you to pay interest on the entire loan, whether you use part of it or all, whether you pay it off much quicker or keep it to the end of the term.

Many business lines of credit are unsecured, which means you don’t need any collateral and they are often very fast to get approval for, usually within a matter of days.

In some cases for amounts less than $250,000, you could get a link of credit loan within the same day of applying, getting approved, and getting funded. The interest rates however, are usually higher.

16. Equipment loans for Small Businesses

One of the most popular types of loans for businesses with revenues less than $10 million per year, is the simple and straightforward equipment loan. If a business needs to finance a large equipment purchase, but don’t have the capital, an equipment loan is often the best option.

These loans are designed to help business owner pay for expensive equipment, plant machinery, delivery vehicles or other equipment that retains value, at leas for a while, such as computers or furniture.

In some cases, if the loan amount is above $25,000, the equipment the business purchases will be used as collateral in case the business can’t repay the loan.

17. Invoice Factoring and Receivable Financing Loans for Small Businesses

Most people know this type of business loan as “accounts receivable financing“. Business owners who struggle to receive on-time payments from their customers sell unpaid invoices to a lender and receive a percentage of the invoice value upfront. Or you can use it as collateral. Let’s explain this in more detail.

With invoice financing, you can use unpaid invoices as collateral to get an advance on the amount you’re owed, often anywhere from 35% to 75% depending on they type of customers and the amount of the invoices unpaid.

The main difference between the two above is that factoring gives the company buying your invoices control over collecting payments, while financing still requires you to collect payments so you can repay the amount borrowed. Depending on how much control you are looking for over the collection of the debt, or how likely it is for the customer to pay you for the invoice, you can choose which best meets your needs.

Most credit collection agencies buy back invoice debt or credit debt at about 5%, depending on how long they debt has been outstanding and how likely it is for them to collect. These agencies often collect on about 30% of the invoicing debt and that is how they make their money.

18. Commercial Real Estate Loans for Businesses

Often referred to as “Commercial Mortgages“, the commercial real estate loans are designed to provide cash injection for business owners to finance new or existing property, like an office building, factory or warehouse for inventory storage, or retail space.

These types of loans are very similar to Terms loans, in that both have a term period for repayment, and both have a fixed interest rate for the duration of the loan. Business owners are also free to use the funds (based on land / real estate collateral) to purchase a new commercial property, expand an existing property or even refinance an existing property or Term loan.

19. Microloans for Small Businesses

Loans ranging from $1,000 to $50,000 are referred to as Microloans.

These loan amounts are relatively small, and can be a good option for new businesses or those that don’t need a lot of cash but need a small cash injection to get the business up and running, for instance purchasing inventory or paying office rent.

There are many different types of microloans and these are offered through international organizations, United Nations, World Bank, nonprofits or the government agencies, such as the SBA.

In most cases, businesses need to offer collateral (like business equipment, real estate or personal assets) to qualify for these loans, as well as meeting some other (usually) requirements such as being a “women-business owner”, or “minority-business owner”, etc.

20. Merchant Cash Advances for Small Business Owners with Merchant Accounts

These are often the highest interest rate loans among all. Like traditional cash advances, merchant cash advances are not for the faint hearted.

This makes sense when timing is a critical component for your successful business operation (e.g. marketing and campaigning) and having improved cash flow could be beneficial to your growth and market share expansion.

With this type of cash advance loan, you are required to borrow against your future sales.

In exchange for a lump sum of cash injection into your business, you’ll repay it with either a portion of your daily credit card sales or through weekly transfers from your bank account.

In this situation this type of loan makes sense only when you’ll need quick and easy funding, and a merchant cash advance could be the best way for you to receive a lump sum amount that will save you a lot money elsewhere or generate higher sales that makes the extra cost worthwhile.

While you can often quickly obtain a merchant cash advance, the high interest rates make this type of loan less than popular or desirable.

Unlike terms loans or receivables invoice financing or factoring, merchant cash advances use credit card sales as collateral, instead of unpaid invoices or land/property.

21. Franchise Operation Loans for Small Businesses

At any one time, there are about 100,000+ franchise businesses being sold in U.S.

Becoming a franchisee can help business entrepreneurs achieve their goal of business ownership quicker and easier than starting from the ground up, though you’ll still need capital to purchase an existing franchise and learn their business operation and marketing strategies.

Franchise loans can provide entrepreneurs and new startups with the money to pay the upfront fee for opening a franchise, to get up and running fast.

In about 50% of cases there are pre-approved lending organizations who give a kickback to the franchise owners for lending money to a prospective buyer.

However. there are also some franchisors who offer funding to new franchisees.

22. Purchase Loans to Acquire a Small Business

New business owners in almost every industry need capital to purchase or acquire a new business.

There are various options available, but as always not everyone is eligible for a loan.

In fact, new small to medium sized businesses often struggle to find banks that are willing to lend them money.

Fortunately, new businesses typically don’t need to have the credentials needed/expected to prove themselves trustworthy in the eyes of many traditional banking lenders.

There are now a variety of loan options to help new business owners to procure business funding to make a purchase of an existing business.

In conclusion:

The best business loan is generally the one with the lowest rates and most ideal terms. But other factors also play a key role in selecting the best loan for your business.

These include: time to fund, your business’s qualifications, credit rating, flexibility of options, how quickly the funds are available, etc.

There are so many options for business borrowers and, these days, smaller lenders have flexible options and less draconian borrower qualifications than larger, traditional banks.

While APRs for smaller and less traditional lenders may be higher than traditional lenders, approval rates also are higher and borrowers are less likely to need collateral.

What’s more, many smaller lending institutions provide faster funding speeds than their brick-and-mortar counterparts like banks, making them a good option for businesses that need cash quickly.

--- article sharing ---