July 24th, 2024

Whether you’re launching a new startup business or you already have an existing business, be it a retail or an online business, you already know that you most certainly need to accept credit card payments from your customers. These days without accepting credit card payments in your business, you have little chance of success as 81% of consumers prefer using credit card payments over cash payments when making a purchase.

For your business to accept credit card payments from customers you will need either a merchant account for credit card processing or you need to use a third-party processor like PayPal or one of their competitors.

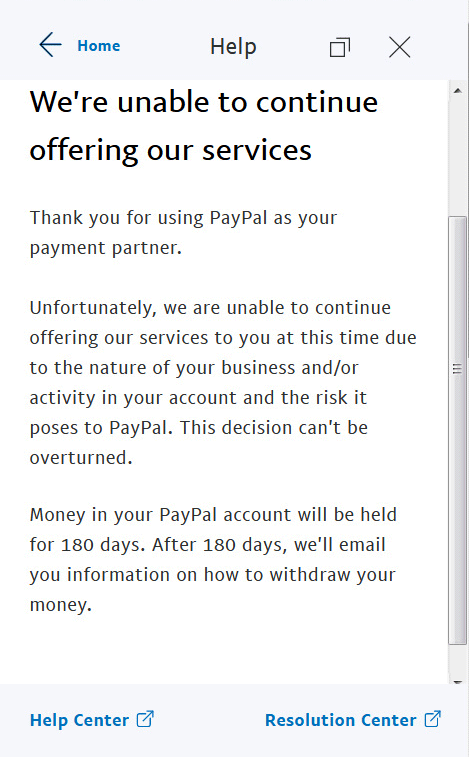

So why should your business care whether accepting payments from customers are processed through PayPal or a merchant account from a bank or merchant account company? Because PayPal’s aggregating card processing, does lead to a higher amount of risk for your business, which translates to frozen funds by PayPal or even account terminations, as you no doubt have read about again and again regarding PayPal’s business services.

But, you are thinking to yourself, aren’t they all the same for processing a credit card payment from a customer?

No, they are not. Certainly, they are not equal from the point of view of a business owner.

Let me explain.

PayPal is not a merchant account provider. It is a third-party processor. There are many names to describe what a third-party processor is, e.g. “payment service provider”, or “merchant aggregator”. What all of these mean is that PayPal is a BUSINESS that has a merchant account and offers processing on its own merchant account (with one or more banks), and “AGGREGATES” all payments from its customers and processes them as a third-party.

So you don’t have a “PayPal merchant account” and you never got one (if you are using PayPal for your business right now). There is NO PAYPAL MERCHANT ACCOUNT for businesses, because it doesn’t exist.

If you are accepting credit card payments from your customers then your transactions are lumped in with millions of other users of PayPal and it is being processed using single/multiple PayPal merchant account(s). You do not have a merchant account of your own.

Having a merchant account for your business involves an application for such through your business before you are set up with your own dedicated account and a unique merchant ID number, from either a bank or a merchant account company that is affiliated to a bank or sales organization registered with one of the major banks.

So why should a business care whether accepting payments from customers are processed through PayPal or a merchant account from a bank or merchant account company? Because aggregating does lead to a higher amount of risk for your business, which translates to held funds by PayPal or even account terminations, as you no doubt have read about again and again.

Using PayPal as your payment processor for your business is a risk. At the first earliest warning sign for a suspicious transaction, you could see your problems start with your PayPal business account. PayPal’s business model is based on offering you , as a business, a very quick and easy way (although in reality, it isn’t so) to get started with getting credit card payment from your customers. But once your business depends on this processing of payment from your customers, PayPal then starts to go through an INFORMAL underwriting process of establishing risk associated to processing transactions for your business.

I, for one, rather go through the process of getting a merchant account for my business right from get go. Yes, you have to fill out an application, you have to wait one or even a few days, but then you know where you stand and your merchant account is YOURS, not a third-party processing that can shut you down at any time, while your business can’t get payments from your customers, and even worse, your funds being frozen by PayPal when you need it the most.

--- article sharing ---